Beyond The Numbers: 4 Analysts Discuss Pacific Biosciences Stock

Ratings for Pacific Biosciences (NASDAQ:PACB) were provided by 4 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

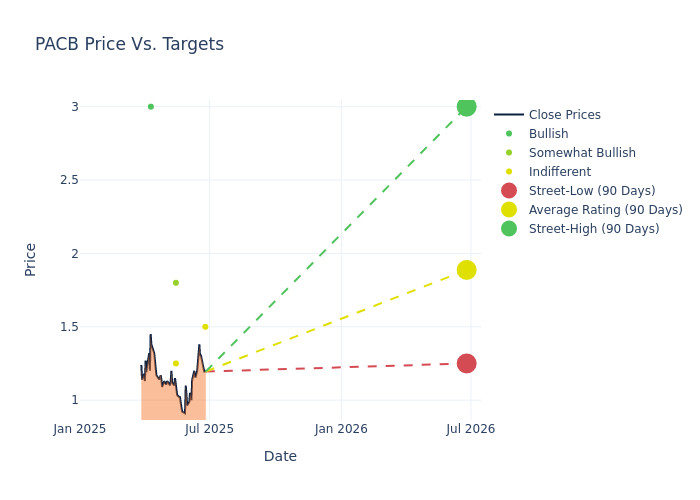

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $1.89, with a high estimate of $3.00 and a low estimate of $1.25. A negative shift in sentiment is evident as analysts have decreased the average price target by 14.09%.

Breaking Down Analyst Ratings: A Detailed Examination

The standing of Pacific Biosciences among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Luke Sergott | Barclays | Lowers | Equal-Weight | $1.50 | $2.00 |

| David Westenberg | Piper Sandler | Lowers | Neutral | $1.25 | $2.00 |

| Mason Carrico | Stephens & Co. | Maintains | Overweight | $1.80 | $1.80 |

| Kyle Mikson | Canaccord Genuity | Maintains | Buy | $3.00 | $3.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Pacific Biosciences. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Pacific Biosciences compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Pacific Biosciences's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Pacific Biosciences's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Pacific Biosciences analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Pacific Biosciences

Pacific Biosciences of California Inc is a biotechnology company focused on designing, developing, and manufacturing sequencing solutions that enable scientists and clinical researchers to improve their understanding of the genome and ultimately, resolve genetically complex problems. It operates in, one reportable segment: the development, manufacturing, and marketing of an integrated platform for genetic analysis. The majority of the company's revenue is derived from Americas, followed by Asia-Pacific and Europe Middle East, and Africa.

Unraveling the Financial Story of Pacific Biosciences

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Negative Revenue Trend: Examining Pacific Biosciences's financials over 3M reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -4.27% in revenue growth, reflecting a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: Pacific Biosciences's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -1146.81%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Pacific Biosciences's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -142.44%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Pacific Biosciences's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -40.17%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 7.63, caution is advised due to increased financial risk.

The Core of Analyst Ratings: What Every Investor Should Know

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for PACB

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Canaccord Genuity | Maintains | Buy | |

| Sep 2021 | Canaccord Genuity | Initiates Coverage On | Buy | |

| Aug 2021 | Morgan Stanley | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings