Assessing Targa Resources: Insights From 12 Financial Analysts

Across the recent three months, 12 analysts have shared their insights on Targa Resources (NYSE:TRGP), expressing a variety of opinions spanning from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 9 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 3 | 6 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

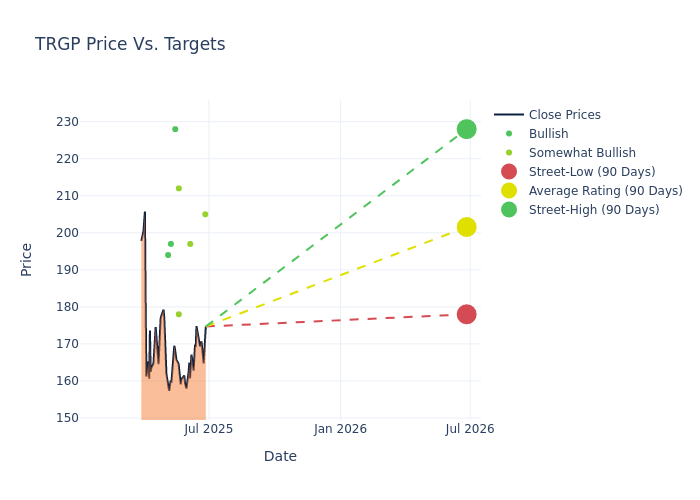

Analysts have recently evaluated Targa Resources and provided 12-month price targets. The average target is $201.5, accompanied by a high estimate of $228.00 and a low estimate of $178.00. Observing a downward trend, the current average is 5.1% lower than the prior average price target of $212.33.

Deciphering Analyst Ratings: An In-Depth Analysis

A clear picture of Targa Resources's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Elvira Scotto | RBC Capital | Raises | Outperform | $205.00 | $191.00 |

| Brandon Bingham | Scotiabank | Raises | Sector Outperform | $197.00 | $193.00 |

| Gabriel Moreen | Mizuho | Lowers | Outperform | $212.00 | $218.00 |

| Brandon Bingham | Scotiabank | Lowers | Sector Outperform | $193.00 | $199.00 |

| Theresa Chen | Barclays | Lowers | Overweight | $178.00 | $206.00 |

| Shneur Gershuni | UBS | Lowers | Buy | $228.00 | $259.00 |

| Spiro Dounis | Citigroup | Lowers | Buy | $197.00 | $227.00 |

| Elvira Scotto | RBC Capital | Lowers | Outperform | $191.00 | $199.00 |

| John Mackay | Goldman Sachs | Lowers | Buy | $194.00 | $218.00 |

| Brandon Bingham | Scotiabank | Lowers | Sector Outperform | $199.00 | $201.00 |

| Gabriel Moreen | Mizuho | Lowers | Outperform | $218.00 | $226.00 |

| Theresa Chen | Barclays | Lowers | Overweight | $206.00 | $211.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Targa Resources. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Targa Resources compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Targa Resources's stock. This examination reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Targa Resources's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Targa Resources analyst ratings.

All You Need to Know About Targa Resources

Targa Resources is a midstream firm that primarily operates gathering and processing assets with substantial positions in the Permian, Stack, Scoop, and Bakken plays. It has fractionation capacity at Mont Belvieu and operates a liquefied petroleum gas export terminal. The Grand Prix natural gas liquids pipeline is another important asset.

A Deep Dive into Targa Resources's Financials

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Negative Revenue Trend: Examining Targa Resources's financials over 3M reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -0.02% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Energy sector.

Net Margin: Targa Resources's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 4.38%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Targa Resources's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 7.93%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Targa Resources's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.88%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 6.61, caution is advised due to increased financial risk.

How Are Analyst Ratings Determined?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for TRGP

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Raymond James | Maintains | Strong Buy | |

| Jan 2022 | Raymond James | Maintains | Strong Buy | |

| Jan 2022 | Barclays | Maintains | Overweight |

Posted-In: BZI-AARAnalyst Ratings