The Analyst Verdict: Lincoln National In The Eyes Of 6 Experts

Analysts' ratings for Lincoln National (NYSE:LNC) over the last quarter vary from bullish to bearish, as provided by 6 analysts.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 5 | 1 | 0 |

| Last 30D | 0 | 0 | 0 | 1 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 3 | 0 | 0 |

| 3M Ago | 0 | 0 | 2 | 0 | 0 |

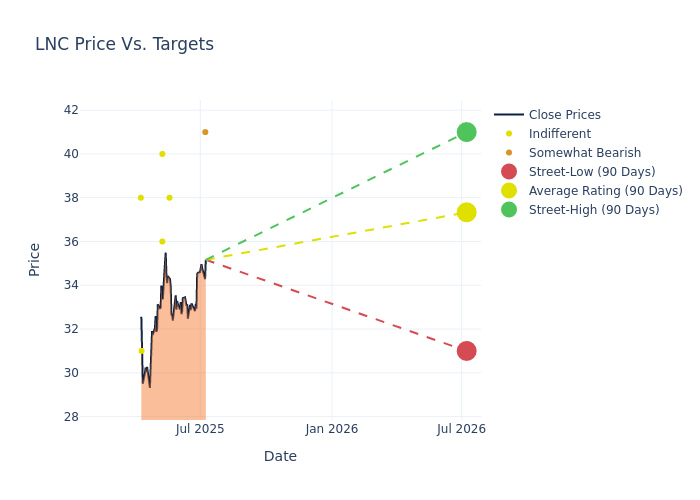

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $36.33, a high estimate of $41.00, and a low estimate of $31.00. A 2.68% drop is evident in the current average compared to the previous average price target of $37.33.

Exploring Analyst Ratings: An In-Depth Overview

In examining recent analyst actions, we gain insights into how financial experts perceive Lincoln National. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jimmy Bhullar | JP Morgan | Raises | Underweight | $41.00 | $38.00 |

| Nigel Dally | Morgan Stanley | Raises | Equal-Weight | $38.00 | $32.00 |

| John Barnidge | Piper Sandler | Lowers | Neutral | $36.00 | $38.00 |

| Alex Scott | Barclays | Raises | Equal-Weight | $40.00 | $38.00 |

| Elyse Greenspan | Wells Fargo | Lowers | Equal-Weight | $31.00 | $36.00 |

| Nigel Dally | Morgan Stanley | Lowers | Equal-Weight | $32.00 | $42.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Lincoln National. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Lincoln National compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Lincoln National's stock. This analysis reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Lincoln National's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Lincoln National analyst ratings.

Discovering Lincoln National: A Closer Look

Lincoln National Corp operates multiple insurance and retirement businesses. The company's operating segment includes Annuities; Retirement Plan Services; Life Insurance and Group Protection. Its products include fixed and indexed annuities, variable annuities, universal life insurance (UL), variable universal life insurance (VUL), linked-benefit UL and VUL, indexed universal life insurance (IUL), term life insurance, employer-sponsored retirement plans and services, and group life, disability and dental.

Financial Milestones: Lincoln National's Journey

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3M period, Lincoln National showcased positive performance, achieving a revenue growth rate of 14.62% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Financials sector.

Net Margin: Lincoln National's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -16.02%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -10.43%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Lincoln National's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -0.2%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Lincoln National's debt-to-equity ratio surpasses industry norms, standing at 0.81. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Significance of Analyst Ratings Explained

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for LNC

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Goldman Sachs | Downgrades | Buy | Neutral |

| Feb 2022 | Morgan Stanley | Maintains | Overweight | |

| Feb 2022 | Morgan Stanley | Maintains | Overweight |

Posted-In: BZI-AARAnalyst Ratings