9 Analysts Assess Eastman Chemical: What You Need To Know

During the last three months, 9 analysts shared their evaluations of Eastman Chemical (NYSE:EMN), revealing diverse outlooks from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 3 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 2 | 3 | 0 | 0 |

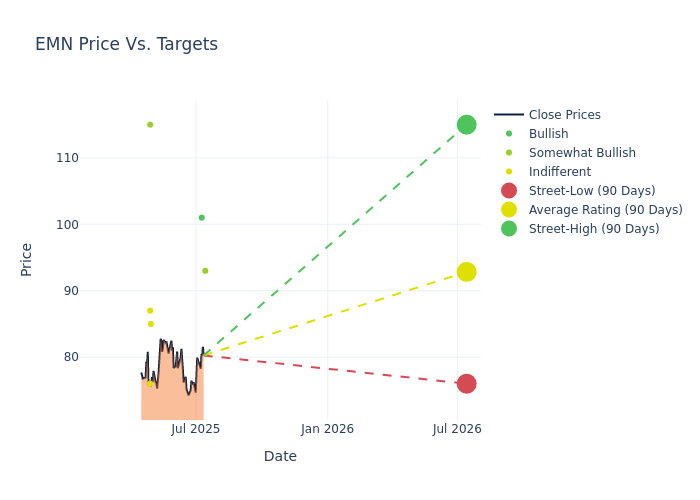

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $97.89, along with a high estimate of $115.00 and a low estimate of $76.00. A 13.29% drop is evident in the current average compared to the previous average price target of $112.89.

Analyzing Analyst Ratings: A Detailed Breakdown

A comprehensive examination of how financial experts perceive Eastman Chemical is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Scott Schoenhaus | Keybanc | Lowers | Overweight | $93.00 | $106.00 |

| Joshua Spector | UBS | Lowers | Buy | $101.00 | $107.00 |

| Joshua Spector | UBS | Lowers | Buy | $107.00 | $111.00 |

| Michael Leithead | Barclays | Lowers | Equal-Weight | $85.00 | $108.00 |

| Duffy Fischer | Goldman Sachs | Lowers | Neutral | $87.00 | $112.00 |

| Aleksey Yefremov | Keybanc | Lowers | Overweight | $106.00 | $120.00 |

| Vincent Andrews | Morgan Stanley | Lowers | Overweight | $115.00 | $125.00 |

| Jeffrey Zekaukas | JP Morgan | Lowers | Neutral | $76.00 | $112.00 |

| Joshua Spector | UBS | Lowers | Buy | $111.00 | $115.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Eastman Chemical. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Eastman Chemical compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Eastman Chemical's stock. This examination reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Eastman Chemical's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Eastman Chemical analyst ratings.

Discovering Eastman Chemical: A Closer Look

Established in 1920 to produce chemicals for Eastman Kodak, Eastman Chemical has grown into a global specialty chemical company with manufacturing sites around the world. The company generates the majority of its sales outside of the United States, with a strong presence in Asian markets. During the past several years, Eastman has sold noncore businesses, choosing to focus on higher-margin specialty product offerings.

Eastman Chemical: Financial Performance Dissected

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Eastman Chemical's revenue growth over a period of 3M has faced challenges. As of 31 March, 2025, the company experienced a revenue decline of approximately -0.87%. This indicates a decrease in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Materials sector.

Net Margin: Eastman Chemical's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 7.95%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Eastman Chemical's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 3.12%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Eastman Chemical's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.21%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.86.

What Are Analyst Ratings?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for EMN

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Piper Sandler | Maintains | Neutral | |

| Jan 2022 | Barclays | Maintains | Equal-Weight | |

| Jan 2022 | Morgan Stanley | Maintains | Overweight |

Posted-In: BZI-AARAnalyst Ratings