Expert Outlook: Mastercard Through The Eyes Of 10 Analysts

Mastercard (NYSE:MA) has been analyzed by 10 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 8 | 2 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 4 | 0 | 0 | 0 | 0 |

| 3M Ago | 3 | 2 | 0 | 0 | 0 |

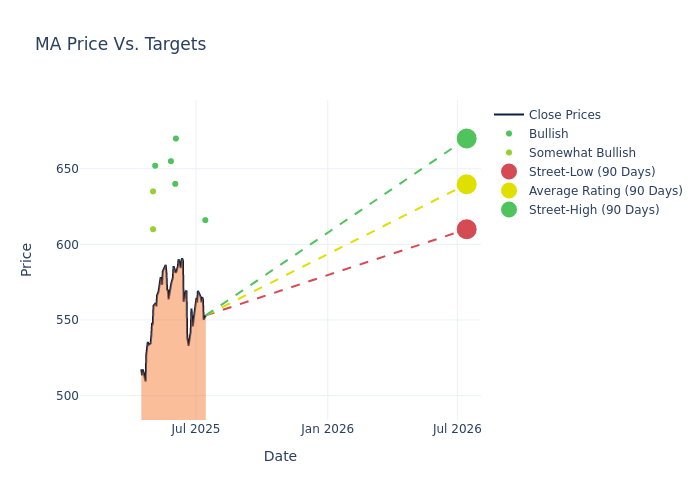

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $640.8, with a high estimate of $670.00 and a low estimate of $610.00. Observing a downward trend, the current average is 0.41% lower than the prior average price target of $643.44.

Deciphering Analyst Ratings: An In-Depth Analysis

An in-depth analysis of recent analyst actions unveils how financial experts perceive Mastercard. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jeff Cantwell | Seaport Global | Maintains | Buy | $616.00 | $616.00 |

| Timothy Chiodo | UBS | Raises | Buy | $670.00 | $660.00 |

| Matthew Coad | Truist Securities | Announces | Buy | $640.00 | - |

| Timothy Chiodo | UBS | Raises | Buy | $660.00 | $640.00 |

| Trevor Williams | Jefferies | Raises | Buy | $655.00 | $630.00 |

| Andrew Schmidt | Citigroup | Raises | Buy | $652.00 | $650.00 |

| Trevor Williams | Jefferies | Lowers | Buy | $630.00 | $660.00 |

| Timothy Chiodo | UBS | Lowers | Buy | $640.00 | $660.00 |

| Jeffrey Hammond | Keybanc | Raises | Overweight | $635.00 | $630.00 |

| Paul Golding | Macquarie | Lowers | Outperform | $610.00 | $645.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Mastercard. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Mastercard compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Mastercard's stock. This analysis reveals shifts in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Mastercard's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Mastercard analyst ratings.

All You Need to Know About Mastercard

Mastercard is the second-largest payment processor in the world, having processed close to $10 trillion in volume during 2024. Mastercard operates in over 200 countries and processes transactions in over 150 currencies.

Financial Milestones: Mastercard's Journey

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Mastercard's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 14.21%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Mastercard's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 45.24%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Mastercard's ROE excels beyond industry benchmarks, reaching 49.86%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Mastercard's ROA excels beyond industry benchmarks, reaching 6.79%. This signifies efficient management of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 2.82, caution is advised due to increased financial risk.

Understanding the Relevance of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for MA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Morgan Stanley | Maintains | Overweight | |

| Jan 2022 | Raymond James | Maintains | Outperform | |

| Jan 2022 | Raymond James | Maintains | Outperform |

Posted-In: BZI-AARAnalyst Ratings