Breaking Down Simulations Plus: 4 Analysts Share Their Views

In the last three months, 4 analysts have published ratings on Simulations Plus (NASDAQ:SLP), offering a diverse range of perspectives from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

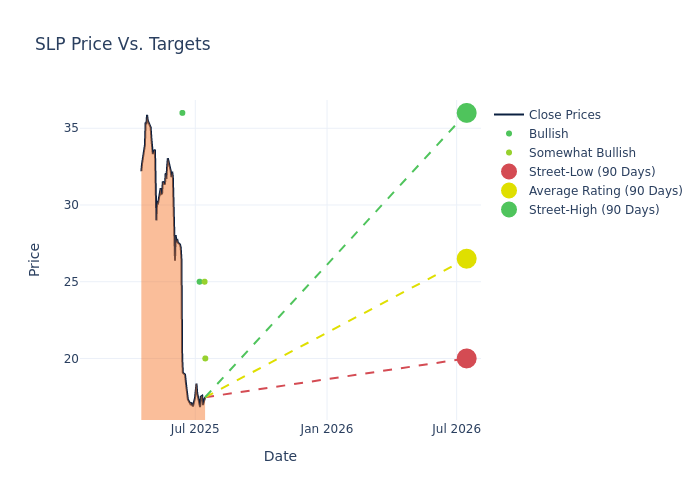

Insights from analysts' 12-month price targets are revealed, presenting an average target of $26.5, a high estimate of $36.00, and a low estimate of $20.00. This current average represents a 31.17% decrease from the previous average price target of $38.50.

Understanding Analyst Ratings: A Comprehensive Breakdown

A clear picture of Simulations Plus's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jeff Garro | Stephens & Co. | Lowers | Overweight | $20.00 | $28.00 |

| Scott Schoenhaus | Keybanc | Lowers | Overweight | $25.00 | $40.00 |

| David Larsen | BTIG | Lowers | Buy | $25.00 | $41.00 |

| Matt Hewitt | Craig-Hallum | Lowers | Buy | $36.00 | $45.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Simulations Plus. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Simulations Plus compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Simulations Plus's stock. This analysis reveals shifts in analysts' expectations over time.

To gain a panoramic view of Simulations Plus's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Simulations Plus analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

About Simulations Plus

Simulations Plus Inc is engaged in the software industry. It includes two segments. It develops and produces software for use in pharmaceutical research and education, and provides consulting and contract research services to the pharmaceutical industry. The company's operating segments include Software and services. The company offers software products for pharmaceutical research such as ADMET (Absorption, Distribution, Metabolism, Excretion, and Toxicity). It generates maximum revenue from the software segment. Maximum revenue is earned from USA following EMEA and Asia Pacific.

Simulations Plus: Delving into Financials

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Simulations Plus displayed positive results in 3M. As of 28 February, 2025, the company achieved a solid revenue growth rate of approximately 22.55%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Net Margin: Simulations Plus's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 13.7%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 1.64%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Simulations Plus's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.54%, the company showcases efficient use of assets and strong financial health.

Debt Management: Simulations Plus's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.0.

How Are Analyst Ratings Determined?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for SLP

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Oct 2021 | Craig-Hallum | Upgrades | Hold | Buy |

| Jul 2021 | Raymond James | Maintains | Outperform | |

| Jan 2021 | Craig-Hallum | Downgrades | Buy | Hold |

Posted-In: BZI-AARAnalyst Ratings