Analyst Expectations For Entegris's Future

In the latest quarter, 10 analysts provided ratings for Entegris (NASDAQ:ENTG), showcasing a mix of bullish and bearish perspectives.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 3 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 1 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 3 | 1 | 2 | 0 | 0 |

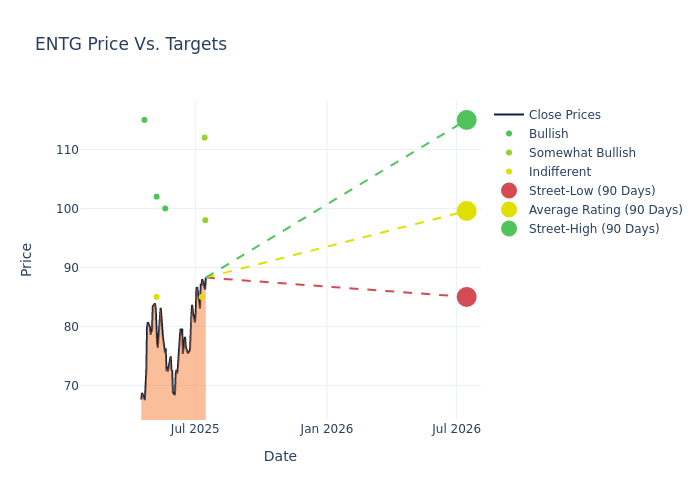

Insights from analysts' 12-month price targets are revealed, presenting an average target of $100.4, a high estimate of $117.00, and a low estimate of $85.00. A 12.86% drop is evident in the current average compared to the previous average price target of $115.22.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Entegris among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| John Roberts | Mizuho | Raises | Outperform | $98.00 | $90.00 |

| Aleksey Yefremov | Keybanc | Lowers | Overweight | $112.00 | $117.00 |

| James Schneider | Goldman Sachs | Announces | Neutral | $85.00 | - |

| Charles Shi | Needham | Maintains | Buy | $100.00 | $100.00 |

| Atif Malik | Citigroup | Lowers | Buy | $102.00 | $125.00 |

| Timothy Arcuri | UBS | Lowers | Neutral | $85.00 | $90.00 |

| Aleksey Yefremov | Keybanc | Lowers | Overweight | $117.00 | $130.00 |

| Charles Shi | Needham | Lowers | Buy | $100.00 | $120.00 |

| Timothy Arcuri | UBS | Lowers | Neutral | $90.00 | $115.00 |

| Michael Harrison | Seaport Global | Lowers | Buy | $115.00 | $150.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Entegris. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Entegris compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Entegris's stock. This examination reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Entegris's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Entegris analyst ratings.

All You Need to Know About Entegris

Entegris is a leading supplier of purification solutions and advanced materials. The vast majority of sales are to the semiconductor industry. The majority of revenue comes from semiconductor fabricators, but the company sells to all areas of the semiconductor manufacturing supply chain including equipment and engineering, chemicals and materials, and distributors. Entegris specializes in materials science and materials purity, both of which are crucial in the semiconductor manufacturing process.

Financial Milestones: Entegris's Journey

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Entegris's revenue growth over a period of 3M has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 0.29%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Entegris's net margin excels beyond industry benchmarks, reaching 8.13%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Entegris's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 1.69%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Entegris's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.75%, the company showcases efficient use of assets and strong financial health.

Debt Management: Entegris's debt-to-equity ratio stands notably higher than the industry average, reaching 1.08. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Basics of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for ENTG

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Mizuho | Upgrades | Neutral | Buy |

| Jan 2022 | Deutsche Bank | Upgrades | Hold | Buy |

| Jan 2022 | Seaport Global | Upgrades | Neutral | Buy |

Posted-In: BZI-AARAnalyst Ratings