Assessing Kenvue: Insights From 6 Financial Analysts

Throughout the last three months, 6 analysts have evaluated Kenvue (NYSE:KVUE), offering a diverse set of opinions from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 0 | 5 | 0 | 0 |

| Last 30D | 1 | 0 | 2 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 3 | 0 | 0 |

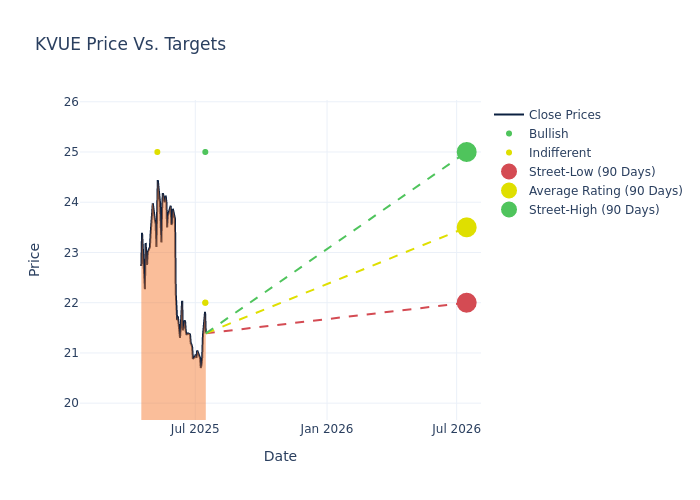

The 12-month price targets, analyzed by analysts, offer insights with an average target of $23.58, a high estimate of $25.00, and a low estimate of $22.00. This current average has decreased by 0.72% from the previous average price target of $23.75.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Kenvue among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Filippo Falorni | Citigroup | Lowers | Neutral | $22.00 | $24.50 |

| Lauren Lieberman | Barclays | Lowers | Equal-Weight | $22.00 | $23.00 |

| Anna Lizzul | B of A Securities | Lowers | Buy | $25.00 | $27.00 |

| Lauren Lieberman | Barclays | Raises | Equal-Weight | $23.00 | $22.00 |

| Peter Grom | UBS | Raises | Neutral | $25.00 | $24.00 |

| Filippo Falorni | Citigroup | Raises | Neutral | $24.50 | $22.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Kenvue. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Kenvue compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Kenvue's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Kenvue's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Kenvue analyst ratings.

Delving into Kenvue's Background

Kenvue is the world's largest pure-play consumer health company by sales, generating over $15 billion in annual revenue. Formerly known as Johnson & Johnson's consumer segment, Kenvue spun off and went public in May 2023. It operates in a variety of silos within consumer health, such as cough, cold and allergy care, pain management, face and body care, and oral care, as well as women's health. Its portfolio has some of the most well-known brands in the space, including Tylenol, Listerine, Johnson's, Aveeno, and Neutrogena. Despite playing in a fragmented industry with intense competition and changing consumer preferences, many of Kenvue's brands are the global leader in their respective segment thanks to their strong brand power.

Unraveling the Financial Story of Kenvue

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Kenvue's revenue growth over a period of 3M has faced challenges. As of 31 March, 2025, the company experienced a revenue decline of approximately -3.93%. This indicates a decrease in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Staples sector.

Net Margin: Kenvue's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 8.61%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 3.27%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Kenvue's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.24%, the company showcases efficient use of assets and strong financial health.

Debt Management: Kenvue's debt-to-equity ratio is below the industry average at 0.88, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Significance of Analyst Ratings Explained

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted-In: BZI-AARAnalyst Ratings