Beyond The Numbers: 7 Analysts Discuss Unity Software Stock

Across the recent three months, 7 analysts have shared their insights on Unity Software (NYSE:U), expressing a variety of opinions spanning from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 0 | 2 | 1 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 1 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 1 | 0 | 0 |

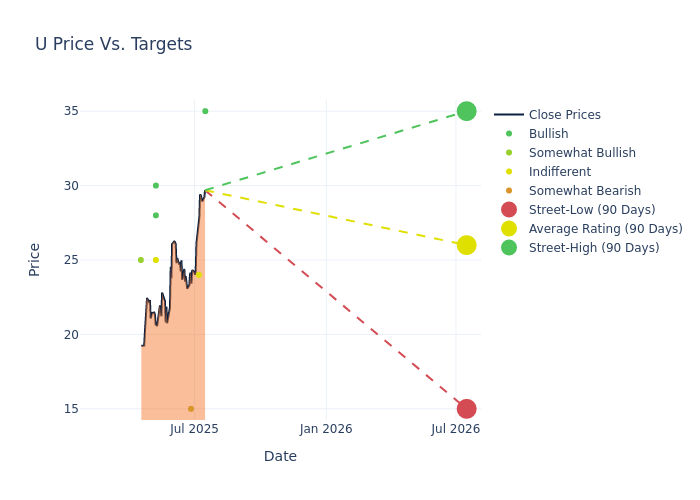

Analysts have set 12-month price targets for Unity Software, revealing an average target of $26.57, a high estimate of $35.00, and a low estimate of $15.00. A decline of 2.78% from the prior average price target is evident in the current average.

Exploring Analyst Ratings: An In-Depth Overview

The perception of Unity Software by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brent Thill | Jefferies | Raises | Buy | $35.00 | $29.00 |

| Alec Brondolo | Wells Fargo | Raises | Equal-Weight | $24.00 | $19.00 |

| Omar Dessouky | B of A Securities | Announces | Underperform | $15.00 | - |

| Brent Thill | Jefferies | Raises | Buy | $29.00 | $22.00 |

| Ross Sandler | Barclays | Lowers | Equal-Weight | $25.00 | $26.00 |

| Parker Lane | Stifel | Lowers | Buy | $28.00 | $35.00 |

| Bernie McTernan | Needham | Lowers | Buy | $30.00 | $33.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Unity Software. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Unity Software compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Unity Software's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Unity Software's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Unity Software analyst ratings.

Discovering Unity Software: A Closer Look

Unity Software Inc provides a software platform for creating and operating interactive, real-time 3D content. The platform can be used to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The business is spread across the United States, Greater China, EMEA, APAC, and other Americas, and key revenue is derived from the EMEA region. The products are used in the gaming industry, retail, automotive, architecture, engineering, and construction.

Unity Software: Financial Performance Dissected

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Challenges: Unity Software's revenue growth over 3M faced difficulties. As of 31 March, 2025, the company experienced a decline of approximately -5.51%. This indicates a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of -17.85%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Unity Software's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -2.44%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Unity Software's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -1.16%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: With a high debt-to-equity ratio of 0.7, Unity Software faces challenges in effectively managing its debt levels, indicating potential financial strain.

Understanding the Relevance of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for U

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Jefferies | Initiates Coverage On | Hold | |

| Feb 2022 | Credit Suisse | Maintains | Outperform | |

| Jan 2022 | BTIG | Upgrades | Neutral | Buy |

Posted-In: BZI-AARAnalyst Ratings