Where SharkNinja Stands With Analysts

During the last three months, 7 analysts shared their evaluations of SharkNinja (NYSE:SN), revealing diverse outlooks from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 2 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 3 | 2 | 1 | 0 | 0 |

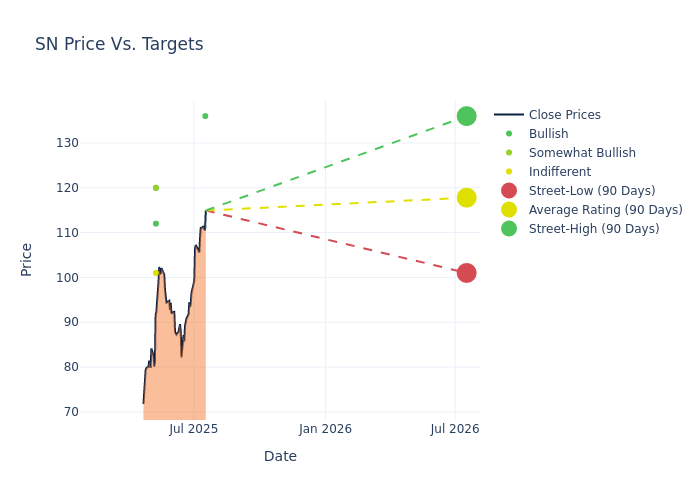

In the assessment of 12-month price targets, analysts unveil insights for SharkNinja, presenting an average target of $113.43, a high estimate of $136.00, and a low estimate of $100.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 2.58%.

Analyzing Analyst Ratings: A Detailed Breakdown

A comprehensive examination of how financial experts perceive SharkNinja is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brian McNamara | Canaccord Genuity | Raises | Buy | $136.00 | $127.00 |

| Brooke Roach | Goldman Sachs | Raises | Buy | $112.00 | $100.00 |

| Rupesh Parikh | Oppenheimer | Raises | Outperform | $120.00 | $105.00 |

| Steven Forbes | Guggenheim | Lowers | Buy | $120.00 | $135.00 |

| Megan Alexander | Morgan Stanley | Raises | Equal-Weight | $101.00 | $85.00 |

| Rupesh Parikh | Oppenheimer | Lowers | Outperform | $105.00 | $130.00 |

| Brooke Roach | Goldman Sachs | Lowers | Buy | $100.00 | $133.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to SharkNinja. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of SharkNinja compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of SharkNinja's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of SharkNinja's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on SharkNinja analyst ratings.

Get to Know SharkNinja Better

SharkNinja Inc is a product design and technology company that creates 5-star-rated lifestyle solutions through inventive products for consumers around the world. Its product categories include Cleaning, Cooking, Food Preparation, Home Environment and Beauty products. It sells vacuum cleaners, cooking pots, fryers, hair dryers, etc. The SharkNinja Group is expected to carry on the design, production, marketing, and distribution of the Shark and Ninja brands of small household appliances in North America, Europe and other selected international markets (excluding the Asia Pacific Region and Greater China). Currently, the majority of the revenue is derived from the U.S. market.

SharkNinja: Delving into Financials

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: SharkNinja's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 14.67%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 9.64%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 5.93%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): SharkNinja's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.75% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.46.

Analyst Ratings: What Are They?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for SN

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Aug 2018 | RBC Capital | Downgrades | Outperform | Sector Perform |

| Apr 2018 | KLR Group | Downgrades | Buy | Hold |

| Feb 2018 | Northland Capital Markets | Downgrades | Outperform | Market Perform |

Posted-In: BZI-AARAnalyst Ratings