Assessing Bank of America: Insights From 9 Financial Analysts

In the last three months, 9 analysts have published ratings on Bank of America (NYSE:BAC), offering a diverse range of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 4 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 2 | 2 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

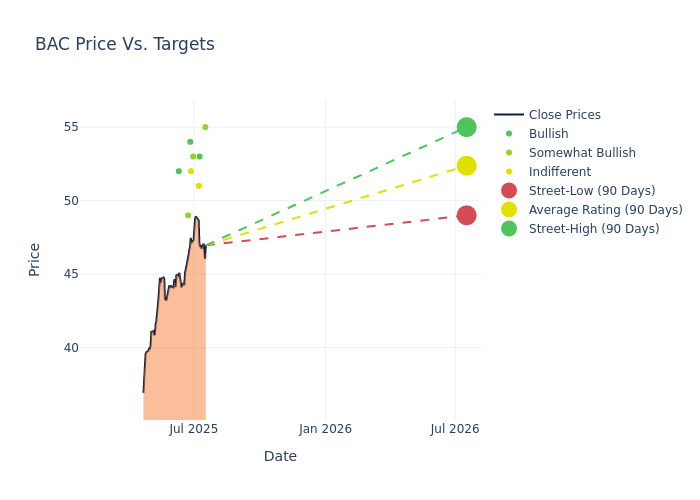

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $52.22, with a high estimate of $55.00 and a low estimate of $49.00. This current average reflects an increase of 5.62% from the previous average price target of $49.44.

Breaking Down Analyst Ratings: A Detailed Examination

The standing of Bank of America among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Chris Kotowski | Oppenheimer | Lowers | Outperform | $55.00 | $57.00 |

| John McDonald | Truist Securities | Raises | Buy | $53.00 | $51.00 |

| Saul Martinez | HSBC | Raises | Hold | $51.00 | $47.00 |

| Gerard Cassidy | RBC Capital | Raises | Outperform | $53.00 | $45.00 |

| David George | Baird | Maintains | Neutral | $52.00 | $52.00 |

| Keith Horowitz | Citigroup | Raises | Buy | $54.00 | $50.00 |

| Betsy Graseck | Morgan Stanley | Raises | Overweight | $49.00 | $47.00 |

| Richard Ramsden | Goldman Sachs | Raises | Buy | $52.00 | $46.00 |

| Chris Kotowski | Oppenheimer | Raises | Outperform | $51.00 | $50.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Bank of America. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Bank of America compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Bank of America's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Bank of America's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Bank of America analyst ratings.

Delving into Bank of America's Background

Bank of America is one of the largest financial institutions in the United States, with more than $3.2 trillion in assets. It is organized into four major segments: consumer banking, global wealth and investment management, global banking, and global markets. Bank of America's consumer-facing lines of business include its network of branches and deposit-gathering operations, retail lending products, credit and debit cards, and small-business services. The company's Merrill Lynch operations provide brokerage and wealth-management services, as does its private bank. Wholesale lines of business include investment banking, corporate and commercial real estate lending, and capital markets operations. Bank of America has operations in several countries but is primarily US-focused.

A Deep Dive into Bank of America's Financials

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Bank of America displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 6.0%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Financials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 25.54%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Bank of America's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 2.55%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Bank of America's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.21%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Bank of America's debt-to-equity ratio is below the industry average at 1.26, reflecting a lower dependency on debt financing and a more conservative financial approach.

Understanding the Relevance of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for BAC

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Baird | Upgrades | Underperform | Neutral |

| Jan 2022 | Morgan Stanley | Maintains | Underweight | |

| Jan 2022 | JP Morgan | Maintains | Overweight |

Posted-In: BZI-AARAnalyst Ratings