Analyst Expectations For Church & Dwight Co's Future

Church & Dwight Co (NYSE:CHD) has been analyzed by 10 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 5 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 4 | 1 | 0 |

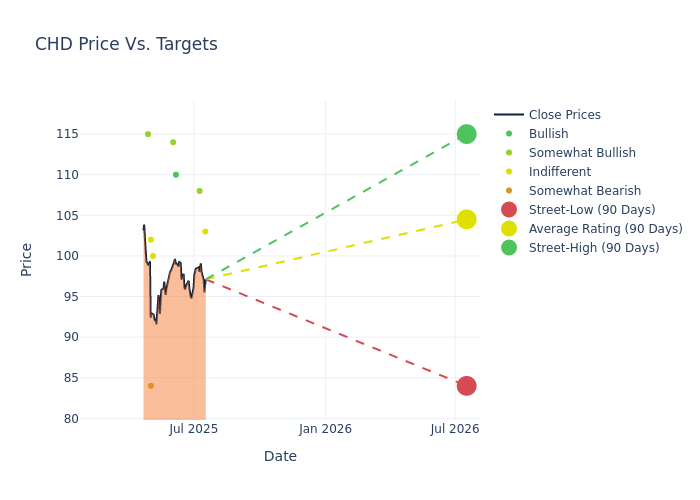

Analysts have set 12-month price targets for Church & Dwight Co, revealing an average target of $103.8, a high estimate of $115.00, and a low estimate of $84.00. Experiencing a 1.33% decline, the current average is now lower than the previous average price target of $105.20.

Interpreting Analyst Ratings: A Closer Look

A comprehensive examination of how financial experts perceive Church & Dwight Co is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Peter Grom | UBS | Raises | Neutral | $103.00 | $102.00 |

| Chris Carey | Wells Fargo | Raises | Overweight | $108.00 | $105.00 |

| Bill Chappell | Truist Securities | Raises | Buy | $110.00 | $100.00 |

| Nik Modi | RBC Capital | Raises | Outperform | $114.00 | $100.00 |

| Dara Mohsenian | Morgan Stanley | Lowers | Equal-Weight | $100.00 | $110.00 |

| Peter Grom | UBS | Lowers | Neutral | $102.00 | $110.00 |

| Lauren Lieberman | Barclays | Lowers | Underweight | $84.00 | $94.00 |

| Nik Modi | RBC Capital | Lowers | Sector Perform | $100.00 | $105.00 |

| Javier Escalante | Evercore ISI Group | Lowers | In-Line | $102.00 | $106.00 |

| Rupesh Parikh | Oppenheimer | Lowers | Outperform | $115.00 | $120.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Church & Dwight Co. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Church & Dwight Co compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Church & Dwight Co's stock. This analysis reveals shifts in analysts' expectations over time.

For valuable insights into Church & Dwight Co's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Church & Dwight Co analyst ratings.

Delving into Church & Dwight Co's Background

Church & Dwight is the leading global producer of baking soda. Its portfolio extends beyond its legacy category to include laundry products, cat litter, oral care, deodorant, and nasal care, all sold under the Arm & Hammer brand. Its mix also includes Batiste, OxiClean, Vitafusion, Hero, and TheraBreath, which together with Arm & Hammer constitute around 70% of its annual sales and profits. Most recently, the firm announced the addition of Touchland, and its hand santizer business, to its fold. Even as it works to grow the reach of its products, Church & Dwight still derives around 80% of its sales from its home market in the US.

Breaking Down Church & Dwight Co's Financial Performance

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Church & Dwight Co's revenue growth over a period of 3M has faced challenges. As of 31 March, 2025, the company experienced a revenue decline of approximately -2.41%. This indicates a decrease in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Staples sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 15.0%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 4.94%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Church & Dwight Co's ROA stands out, surpassing industry averages. With an impressive ROA of 2.47%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a below-average debt-to-equity ratio of 0.48, Church & Dwight Co adopts a prudent financial strategy, indicating a balanced approach to debt management.

What Are Analyst Ratings?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for CHD

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Atlantic Equities | Downgrades | Neutral | Underweight |

| Feb 2022 | Argus Research | Downgrades | Buy | Hold |

| Jan 2022 | Credit Suisse | Downgrades | Outperform | Neutral |

Posted-In: BZI-AARAnalyst Ratings