Deep Dive Into Acushnet Holdings Stock: Analyst Perspectives (5 Ratings)

5 analysts have shared their evaluations of Acushnet Holdings (NYSE:GOLF) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 3 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 2 | 0 | 0 |

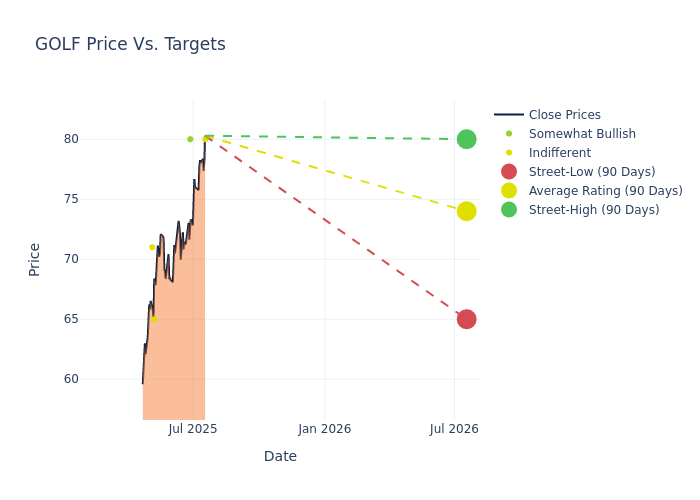

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $74.2, a high estimate of $80.00, and a low estimate of $65.00. This upward trend is evident, with the current average reflecting a 5.4% increase from the previous average price target of $70.40.

Analyzing Analyst Ratings: A Detailed Breakdown

A clear picture of Acushnet Holdings's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Megan Alexander | Morgan Stanley | Raises | Equal-Weight | $80.00 | $63.00 |

| Noah Zatzkin | Keybanc | Raises | Overweight | $80.00 | $75.00 |

| Noah Zatzkin | Keybanc | Raises | Overweight | $75.00 | $70.00 |

| Michael Swartz | Truist Securities | Raises | Hold | $65.00 | $64.00 |

| Casey Alexander | Compass Point | Lowers | Neutral | $71.00 | $80.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Acushnet Holdings. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Acushnet Holdings compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

To gain a panoramic view of Acushnet Holdings's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Acushnet Holdings analyst ratings.

Get to Know Acushnet Holdings Better

Acushnet Holdings Corp is engaged in the design, development, manufacture, and distribution of golf products. Its product category includes golf balls, golf shoes, golf clubs, wedges, putters, golf gloves, golf gear and golf wear, and others. These products are offered through different brands such as Titleist, FootJoy, Scotty Cemeron, Vokey Design, Pinnacle, KJUS, and others. The company's reportable segments are Titleist golf equipment, FootJoy golf wear, and Gofl gear. A majority of its revenue is generated by the Titleist golf equipment segment. Geographically, the company generates maximum revenue from the United States, followed by Europe, Middle East and Asia (EMEA), Japan, Korea, and the Rest of the world.

Acushnet Holdings's Financial Performance

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Challenges: Acushnet Holdings's revenue growth over 3M faced difficulties. As of 31 March, 2025, the company experienced a decline of approximately -0.59%. This indicates a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: Acushnet Holdings's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 14.13%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Acushnet Holdings's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 12.86%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 4.34%, the company showcases effective utilization of assets.

Debt Management: Acushnet Holdings's debt-to-equity ratio stands notably higher than the industry average, reaching 1.21. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Significance of Analyst Ratings Explained

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for GOLF

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Keybanc | Maintains | Overweight | |

| Mar 2022 | Truist Securities | Maintains | Hold | |

| Jan 2022 | Compass Point | Upgrades | Neutral | Buy |

Posted-In: BZI-AARAnalyst Ratings