12 Analysts Have This To Say About Paylocity Holding

12 analysts have shared their evaluations of Paylocity Holding (NASDAQ:PCTY) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 4 | 3 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 4 | 4 | 3 | 0 | 0 |

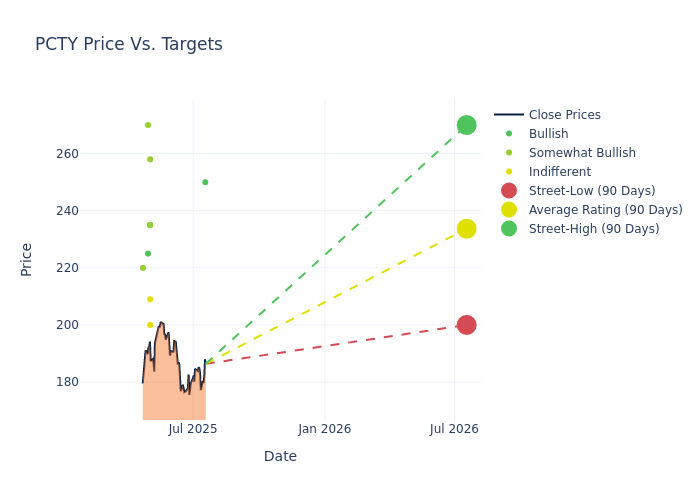

Analysts have recently evaluated Paylocity Holding and provided 12-month price targets. The average target is $232.58, accompanied by a high estimate of $270.00 and a low estimate of $200.00. Experiencing a 4.42% decline, the current average is now lower than the previous average price target of $243.33.

Interpreting Analyst Ratings: A Closer Look

A clear picture of Paylocity Holding's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Scott Berg | Needham | Maintains | Buy | $250.00 | $250.00 |

| Kevin Mcveigh | UBS | Raises | Neutral | $200.00 | $195.00 |

| Raimo Lenschow | Barclays | Raises | Equal-Weight | $209.00 | $204.00 |

| Samad Samana | Jefferies | Lowers | Buy | $235.00 | $255.00 |

| Brian Peterson | Raymond James | Lowers | Outperform | $235.00 | $265.00 |

| Arvind Ramnani | Piper Sandler | Raises | Overweight | $258.00 | $254.00 |

| Brad Reback | Stifel | Lowers | Buy | $235.00 | $250.00 |

| Scott Berg | Needham | Maintains | Buy | $250.00 | $250.00 |

| Patrick Walravens | JMP Securities | Maintains | Market Outperform | $270.00 | $270.00 |

| Steven Enders | Citigroup | Lowers | Buy | $225.00 | $246.00 |

| Ashley Owens | Keybanc | Lowers | Overweight | $220.00 | $250.00 |

| Raimo Lenschow | Barclays | Lowers | Equal-Weight | $204.00 | $231.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Paylocity Holding. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Paylocity Holding compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Paylocity Holding's stock. This examination reveals shifts in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Paylocity Holding's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Paylocity Holding analyst ratings.

All You Need to Know About Paylocity Holding

Founded in 1997, Paylocity is a cloud-based human capital management and payroll platform servicing midmarket customers. The company's average client size is around 150 employees, and its products help with recruiting and onboarding, payroll, time and labor, human resources, benefits, learning, and performance and compensation workflows. As of fiscal 2024, the company generated over $1.4 billion in revenue across more than 39,000 customers.

Paylocity Holding: Delving into Financials

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Positive Revenue Trend: Examining Paylocity Holding's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 13.27% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Net Margin: Paylocity Holding's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 20.13%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Paylocity Holding's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 7.68%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Paylocity Holding's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.75% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Paylocity Holding's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.25.

What Are Analyst Ratings?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for PCTY

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Jefferies | Upgrades | Hold | Buy |

| Feb 2022 | Raymond James | Maintains | Outperform | |

| Feb 2022 | Piper Sandler | Upgrades | Neutral | Overweight |

Posted-In: BZI-AARAnalyst Ratings