Expert Outlook: Toast Through The Eyes Of 9 Analysts

Across the recent three months, 9 analysts have shared their insights on Toast (NYSE:TOST), expressing a variety of opinions spanning from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 3 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 3 | 2 | 0 | 0 |

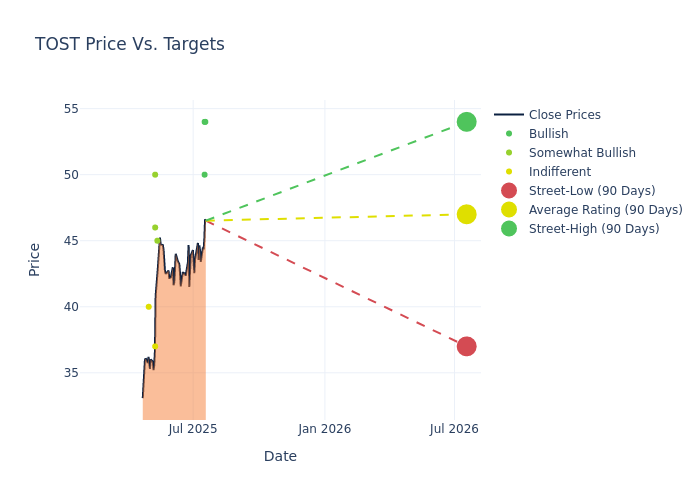

The 12-month price targets, analyzed by analysts, offer insights with an average target of $47.11, a high estimate of $54.00, and a low estimate of $37.00. This current average reflects an increase of 8.47% from the previous average price target of $43.43.

Analyzing Analyst Ratings: A Detailed Breakdown

A comprehensive examination of how financial experts perceive Toast is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Samad Samana | Jefferies | Raises | Buy | $54.00 | $50.00 |

| Matthew Coad | Truist Securities | Raises | Buy | $50.00 | $48.00 |

| Nate Svensson | Deutsche Bank | Announces | Buy | $54.00 | - |

| Matthew Coad | Truist Securities | Announces | Buy | $48.00 | - |

| Rufus Hone | BMO Capital | Raises | Outperform | $45.00 | $44.00 |

| Josh Baer | Morgan Stanley | Raises | Overweight | $50.00 | $46.00 |

| Andrew Bauch | Wells Fargo | Raises | Overweight | $46.00 | $39.00 |

| Clarke Jeffries | Piper Sandler | Raises | Neutral | $37.00 | $35.00 |

| Peter Heckmann | DA Davidson | Lowers | Neutral | $40.00 | $42.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Toast. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Toast compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Toast's stock. This examination reveals shifts in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Toast's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Toast analyst ratings.

About Toast

Toast is a US-based restaurant technology company that provides point-of-sale, payment processing, and various software services to 140,000 restaurant locations across the United States as of the end of March 2025. The firm generates sales from software subscription fees, a percentage take rate from each financial transaction it processes, loan origination and servicing fees from its Toast Capital arm, and hardware installation and professional services. Unlike competitors, Toast intermediates every payment transaction on its platform; it processed some $159 billion in gross platform volume in 2024. The firm's product offerings span point-of-sale systems, inventory and payroll management, delivery integration, e-commerce ordering, reservation management, and loyalty programs.

Toast: Financial Performance Dissected

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Toast's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 24.37%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Financials sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 4.19%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 3.48%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Toast's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 2.25%, the company showcases efficient use of assets and strong financial health.

Debt Management: Toast's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.01.

The Core of Analyst Ratings: What Every Investor Should Know

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for TOST

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Keybanc | Maintains | Overweight | |

| Feb 2022 | Morgan Stanley | Maintains | Overweight | |

| Feb 2022 | Needham | Maintains | Buy |

Posted-In: BZI-AARAnalyst Ratings