Where ManpowerGroup Stands With Analysts

During the last three months, 5 analysts shared their evaluations of ManpowerGroup (NYSE:MAN), revealing diverse outlooks from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 3 | 0 | 0 |

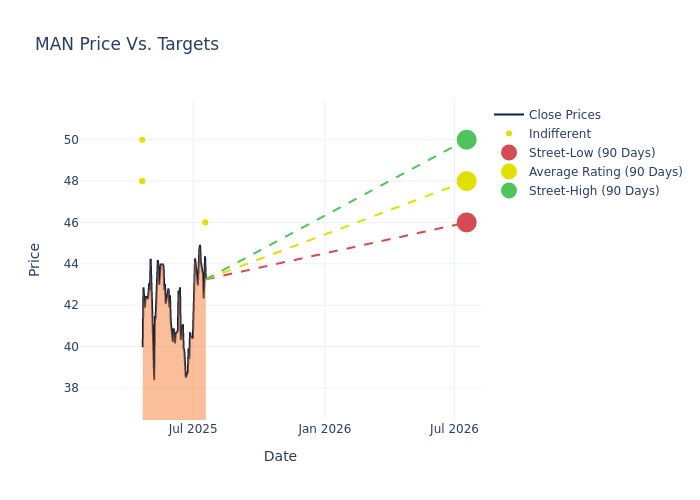

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $47.4, along with a high estimate of $50.00 and a low estimate of $45.00. Highlighting a 9.2% decrease, the current average has fallen from the previous average price target of $52.20.

Breaking Down Analyst Ratings: A Detailed Examination

An in-depth analysis of recent analyst actions unveils how financial experts perceive ManpowerGroup. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Joshua Chan | UBS | Raises | Neutral | $46.00 | $45.00 |

| Joshua Chan | UBS | Raises | Neutral | $45.00 | $42.00 |

| Andrew Steinerman | JP Morgan | Lowers | Neutral | $50.00 | $65.00 |

| Tobey Sommer | Truist Securities | Lowers | Hold | $48.00 | $55.00 |

| Jeffrey Silber | BMO Capital | Lowers | Market Perform | $48.00 | $54.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to ManpowerGroup. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of ManpowerGroup compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for ManpowerGroup's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of ManpowerGroup's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on ManpowerGroup analyst ratings.

Delving into ManpowerGroup's Background

ManpowerGroup Inc. is engaged in providing workforce solutions and services. The company provides services that include Recruitment and Assessment, Upskilling, Reskilling, Training and Development, Career Management, Outsourcing, and Workforce Consulting. The reportable segments of the company are Staffing and Interim, Outcome-Based Solutions and Consulting, Permanent Recruitment, and Others. The Staffing and Interim segment derives the maximum of the company's revenue. The company derives maximum geographical revenue from the Southern European region.

ManpowerGroup's Financial Performance

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: ManpowerGroup's revenue growth over a period of 3M has faced challenges. As of 31 March, 2025, the company experienced a revenue decline of approximately -7.11%. This indicates a decrease in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: ManpowerGroup's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 0.14%, the company may face hurdles in effective cost management.

Return on Equity (ROE): ManpowerGroup's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 0.26%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): ManpowerGroup's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.07%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: ManpowerGroup's debt-to-equity ratio is below the industry average at 0.7, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: Simplified

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for MAN

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Oct 2021 | BMO Capital | Maintains | Outperform | |

| Sep 2021 | Barclays | Downgrades | Overweight | Underweight |

| Aug 2021 | Truist Securities | Maintains | Buy |

Posted-In: BZI-AARAnalyst Ratings