The Analyst Verdict: Pagaya Techs In The Eyes Of 4 Experts

In the latest quarter, 4 analysts provided ratings for Pagaya Techs (NASDAQ:PGY), showcasing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 3 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

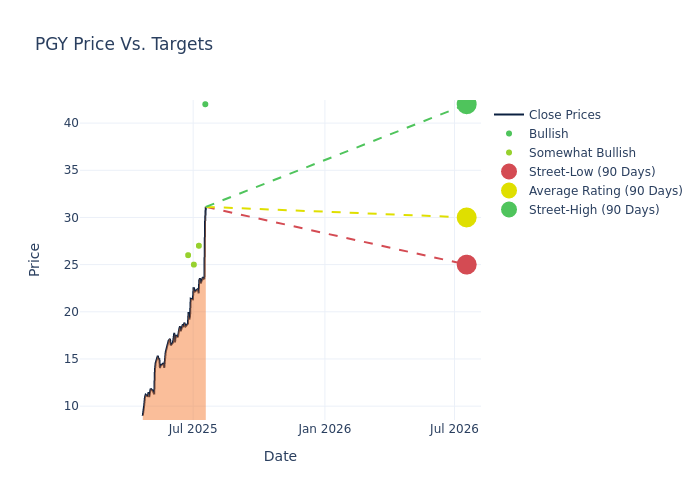

Analysts have recently evaluated Pagaya Techs and provided 12-month price targets. The average target is $30.0, accompanied by a high estimate of $42.00 and a low estimate of $25.00. Observing a 33.33% increase, the current average has risen from the previous average price target of $22.50.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Pagaya Techs among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Mark Palmer | Benchmark | Raises | Buy | $42.00 | $25.00 |

| Sanjay Sakhrani | Keefe, Bruyette & Woods | Raises | Outperform | $27.00 | $23.00 |

| Rayna Kumar | Oppenheimer | Raises | Outperform | $25.00 | $16.00 |

| David Scharf | JMP Securities | Maintains | Market Outperform | $26.00 | $26.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Pagaya Techs. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Pagaya Techs compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Pagaya Techs's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Capture valuable insights into Pagaya Techs's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Pagaya Techs analyst ratings.

Delving into Pagaya Techs's Background

Pagaya Technologies Ltd is a financial technology company working to reshape the lending marketplace by using machine learning, data analytics, and sophisticated AI-driven credit and analysis technology. It was built to provide a comprehensive solution to enable the credit industry to deliver customers a positive experience while simultaneously enhancing the broader credit ecosystem. Its proprietary API seamlessly integrates into its next-gen infrastructure network of partners to deliver a premium customer user experience and greater access to credit. The company generates majority of its revenue from United States.

Pagaya Techs: Delving into Financials

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Pagaya Techs displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 19.28%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Pagaya Techs's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.62% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Pagaya Techs's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.24% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Pagaya Techs's ROA excels beyond industry benchmarks, reaching 0.58%. This signifies efficient management of assets and strong financial health.

Debt Management: Pagaya Techs's debt-to-equity ratio is below the industry average. With a ratio of 2.02, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: Simplified

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted-In: BZI-AARAnalyst Ratings