Where Guidewire Software Stands With Analysts

During the last three months, 16 analysts shared their evaluations of Guidewire Software (NYSE:GWRE), revealing diverse outlooks from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 9 | 4 | 1 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 2 | 0 | 0 | 0 |

| 2M Ago | 2 | 6 | 4 | 1 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

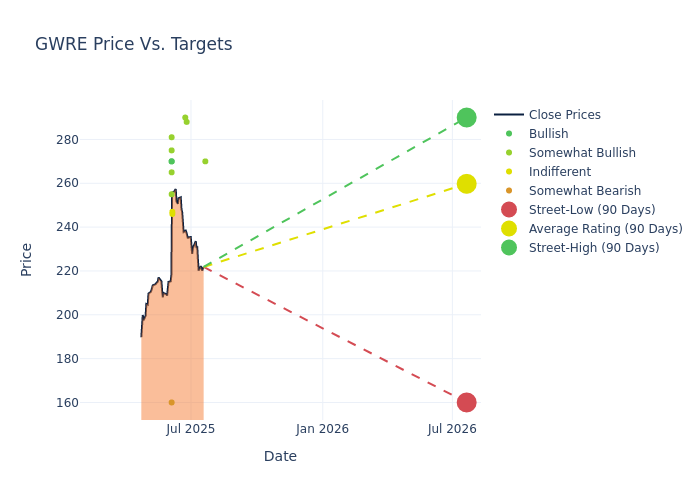

The 12-month price targets, analyzed by analysts, offer insights with an average target of $258.12, a high estimate of $290.00, and a low estimate of $160.00. Surpassing the previous average price target of $230.87, the current average has increased by 11.8%.

Diving into Analyst Ratings: An In-Depth Exploration

The analysis of recent analyst actions sheds light on the perception of Guidewire Software by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Joe Vruwink | Baird | Raises | Outperform | $270.00 | $265.00 |

| Alexei Gogolev | JP Morgan | Raises | Overweight | $288.00 | $271.00 |

| Rishi Jaluria | RBC Capital | Maintains | Outperform | $290.00 | $290.00 |

| Peter Heckmann | DA Davidson | Raises | Neutral | $246.00 | $226.00 |

| Tyler Radke | Citigroup | Raises | Neutral | $247.00 | $199.00 |

| Adam Hotchkiss | Goldman Sachs | Raises | Buy | $270.00 | $235.00 |

| Parker Lane | Stifel | Raises | Buy | $270.00 | $230.00 |

| Alexander Sklar | Raymond James | Raises | Outperform | $255.00 | $225.00 |

| Peter Heckmann | DA Davidson | Maintains | Neutral | $226.00 | $226.00 |

| Alexei Gogolev | JP Morgan | Raises | Overweight | $271.00 | $231.00 |

| Ken Wong | Oppenheimer | Raises | Outperform | $275.00 | $230.00 |

| Rishi Jaluria | RBC Capital | Raises | Outperform | $290.00 | $230.00 |

| Brad Sills | B of A Securities | Raises | Underperform | $160.00 | $135.00 |

| Michael Turrin | Wells Fargo | Raises | Overweight | $265.00 | $220.00 |

| Aaron Kimson | JMP Securities | Raises | Market Outperform | $281.00 | $250.00 |

| Peter Heckmann | DA Davidson | Announces | Neutral | $226.00 | - |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Guidewire Software. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Guidewire Software compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Guidewire Software's stock. This examination reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Guidewire Software's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Guidewire Software analyst ratings.

Unveiling the Story Behind Guidewire Software

Guidewire Software provides software solutions for property and casualty insurers. Flagship product InsuranceSuite is an on-premises system of record and comprises ClaimCenter, a claims management system; PolicyCenter, a policy management system including policy definitions, quotas, issuance, maintenance, and renewal; and BillingCenter, for billing management, payment plans, and agent commissions. The company also offers InsuranceNow, a cloud-based offering, as well as a variety of other add-on applications.

Guidewire Software: Financial Performance Dissected

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Guidewire Software displayed positive results in 3M. As of 30 April, 2025, the company achieved a solid revenue growth rate of approximately 21.95%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Guidewire Software's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 15.67%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Guidewire Software's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 3.5%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Guidewire Software's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.83%, the company showcases efficient use of assets and strong financial health.

Debt Management: Guidewire Software's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.52.

The Significance of Analyst Ratings Explained

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for GWRE

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Wells Fargo | Maintains | Underweight | |

| Dec 2021 | BTIG | Maintains | Buy | |

| Oct 2021 | B of A Securities | Downgrades | Neutral | Underperform |

Posted-In: BZI-AARAnalyst Ratings