What 12 Analyst Ratings Have To Say About Lineage

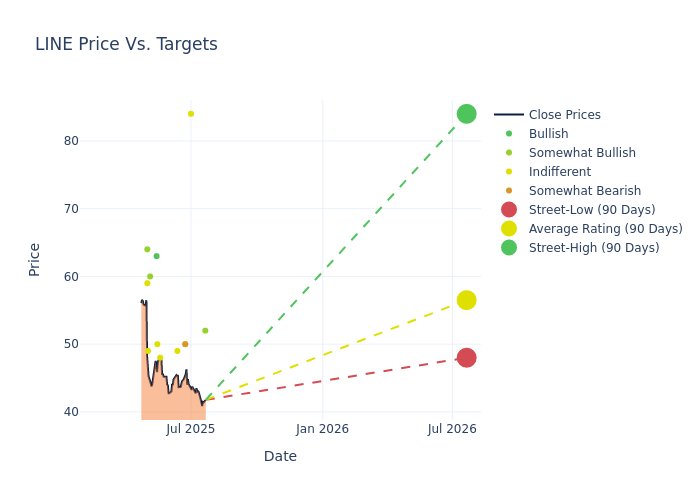

During the last three months, 12 analysts shared their evaluations of Lineage (NASDAQ:LINE), revealing diverse outlooks from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 7 | 1 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 1 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 1 | 2 | 4 | 0 | 0 |

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $56.5, a high estimate of $84.00, and a low estimate of $48.00. Observing a downward trend, the current average is 15.89% lower than the prior average price target of $67.17.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of Lineage among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brendan Lynch | Barclays | Lowers | Overweight | $52.00 | $59.00 |

| Todd Thomas | Keybanc | Maintains | Sector Weight | $84.00 | $84.00 |

| Ronald Kamdem | Morgan Stanley | Lowers | Equal-Weight | $50.00 | $75.00 |

| Michael Mueller | JP Morgan | Lowers | Underweight | $50.00 | $55.00 |

| Craig Mailman | Citigroup | Lowers | Neutral | $49.00 | $64.00 |

| Blaine Heck | Wells Fargo | Lowers | Equal-Weight | $48.00 | $64.00 |

| Greg McGinniss | Scotiabank | Lowers | Sector Perform | $50.00 | $56.00 |

| Caitlin Burrows | Goldman Sachs | Lowers | Buy | $63.00 | $74.00 |

| Alex Goldfarb | Piper Sandler | Lowers | Overweight | $60.00 | $75.00 |

| Michael Goldsmith | UBS | Lowers | Neutral | $49.00 | $62.00 |

| Steve Sakwa | Evercore ISI Group | Lowers | In-Line | $59.00 | $68.00 |

| Nicholas Thillman | Baird | Lowers | Outperform | $64.00 | $70.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Lineage. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Lineage compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Lineage's stock. This examination reveals shifts in analysts' expectations over time.

Capture valuable insights into Lineage's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Lineage analyst ratings.

About Lineage

Lineage Inc is a temperature-controlled warehouse real estate investment trust. It operates an interconnected global temperature-controlled warehouse network, comprising approximately millions of square feet across several warehouses predominantly located in densely populated critical-distribution markets across North America, Asia-Pacific, and Europe. The company's reportable segments are Global Warehousing, which utilizes the company's industrial real estate properties to provide temperature-controlled warehousing services to its customers, and Global Integrated Solutions, which complements Global Warehousing with specialized cold-chain services. Maximum revenue is generated from the Global Warehousing segment. Geographically, the company derives its key revenue from the United States.

Unraveling the Financial Story of Lineage

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Lineage's revenue growth over a period of 3M has faced challenges. As of 31 March, 2025, the company experienced a revenue decline of approximately -2.71%. This indicates a decrease in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Real Estate sector.

Net Margin: Lineage's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 0.15%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Lineage's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 0.02%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Lineage's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.01%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Lineage's debt-to-equity ratio is below the industry average. With a ratio of 0.83, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

How Are Analyst Ratings Determined?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for LINE

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2016 | Goldman Sachs | Terminates Coverage On | Sell | |

| Feb 2016 | Wells Fargo | Downgrades | Market Perform | Underperform |

| Feb 2016 | Citigroup | Downgrades | Neutral | Sell |

Posted-In: BZI-AARAnalyst Ratings