Where Visteon Stands With Analysts

10 analysts have shared their evaluations of Visteon (NASDAQ:VC) during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 2 | 2 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 3 | 0 | 0 |

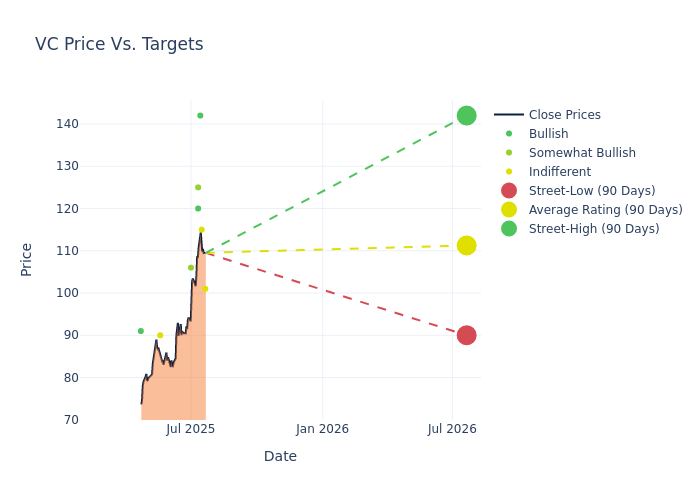

In the assessment of 12-month price targets, analysts unveil insights for Visteon, presenting an average target of $108.3, a high estimate of $142.00, and a low estimate of $86.00. Witnessing a positive shift, the current average has risen by 18.49% from the previous average price target of $91.40.

Investigating Analyst Ratings: An Elaborate Study

An in-depth analysis of recent analyst actions unveils how financial experts perceive Visteon. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ryan Brinkman | JP Morgan | Raises | Neutral | $101.00 | $97.00 |

| Dan Levy | Barclays | Raises | Equal-Weight | $115.00 | $95.00 |

| Joseph Spak | UBS | Raises | Buy | $142.00 | $85.00 |

| Mark Delaney | Goldman Sachs | Raises | Buy | $120.00 | $83.00 |

| Luke Junk | Baird | Raises | Outperform | $125.00 | $96.00 |

| Colin Langan | Wells Fargo | Raises | Overweight | $106.00 | $101.00 |

| Adam Jonas | Morgan Stanley | Lowers | Equal-Weight | $90.00 | $95.00 |

| Colin Langan | Wells Fargo | Raises | Overweight | $101.00 | $96.00 |

| Ryan Brinkman | JP Morgan | Raises | Neutral | $97.00 | $90.00 |

| Luke Junk | Baird | Raises | Neutral | $86.00 | $76.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Visteon. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Visteon compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Visteon's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Visteon's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Visteon analyst ratings.

Discovering Visteon: A Closer Look

Visteon Corp is an automotive supplier. It manufactures electronics products for original equipment vehicle manufacturers including Ford, Nissan, Renault, Mazda, BMW, General Motors, and Honda, etc. The company offers information displays, instrument clusters, head-up displays, infotainment systems, telematics solutions, and Smartcore. The Company's reportable segment is Electronics. The Electronics segment provides vehicle cockpit electronics products to customers, including digital instrument clusters, domain controllers with integrated driver assistance systems, displays, Android-based infotainment systems, and battery management systems. Geographically, it operates in North America, Europe, China, Asia-Pacific, and South America and Others.

Visteon's Economic Impact: An Analysis

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Visteon's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 0.11%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 6.96%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Visteon's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 5.11% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 2.22%, the company showcases effective utilization of assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.34.

Analyst Ratings: What Are They?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for VC

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Goldman Sachs | Upgrades | Neutral | Buy |

| Feb 2022 | Baird | Maintains | Outperform | |

| Feb 2022 | Jefferies | Maintains | Buy |

Posted-In: BZI-AARAnalyst Ratings