Where Qorvo Stands With Analysts

Qorvo (NASDAQ:QRVO) has been analyzed by 8 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 1 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 2 | 0 | 0 |

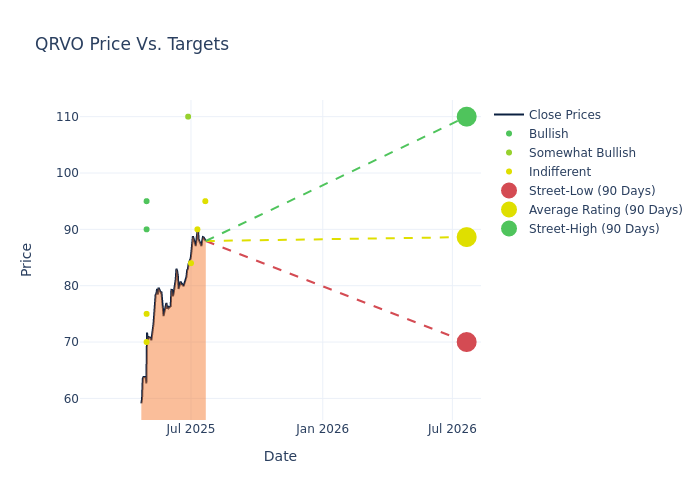

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $88.62, with a high estimate of $110.00 and a low estimate of $70.00. This upward trend is apparent, with the current average reflecting a 4.26% increase from the previous average price target of $85.00.

Analyzing Analyst Ratings: A Detailed Breakdown

A clear picture of Qorvo's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Timothy Arcuri | UBS | Raises | Neutral | $95.00 | $75.00 |

| James Schneider | Goldman Sachs | Announces | Neutral | $90.00 | - |

| Vijay Rakesh | Mizuho | Raises | Neutral | $84.00 | $75.00 |

| Harsh Kumar | Piper Sandler | Maintains | Overweight | $110.00 | $110.00 |

| Tom O'Malley | Barclays | Raises | Equal-Weight | $70.00 | $60.00 |

| Gary Mobley | Loop Capital | Lowers | Hold | $75.00 | $90.00 |

| Cody Acree | Benchmark | Announces | Buy | $95.00 | - |

| Quinn Bolton | Needham | Lowers | Buy | $90.00 | $100.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Qorvo. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Qorvo compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Qorvo's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Qorvo's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Qorvo analyst ratings.

Delving into Qorvo's Background

Qorvo represents the combined entity of RF Micro Devices and TriQuint Semiconductor, which merged in January 2015. The company specializes in radio frequency filters, power amplifiers, and front-end modules used in many of the world's most advanced smartphones. Qorvo also has a suite of products sold into a variety of nonsmartphone end markets, such as wireless base stations, cable TV and networking equipment, and infrastructure and military applications.

Qorvo: Financial Performance Dissected

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Negative Revenue Trend: Examining Qorvo's financials over 3M reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -7.6% in revenue growth, reflecting a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Net Margin: Qorvo's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 3.61%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Qorvo's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 0.93%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Qorvo's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.53%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Qorvo's debt-to-equity ratio surpasses industry norms, standing at 0.46. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

What Are Analyst Ratings?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for QRVO

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Morgan Stanley | Downgrades | Overweight | Equal-Weight |

| Feb 2022 | Benchmark | Maintains | Buy | |

| Feb 2022 | Mizuho | Maintains | Neutral |

Posted-In: BZI-AARAnalyst Ratings