What 13 Analyst Ratings Have To Say About Lyft

In the latest quarter, 13 analysts provided ratings for Lyft (NASDAQ:LYFT), showcasing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 8 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 1 | 3 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 4 | 0 | 0 |

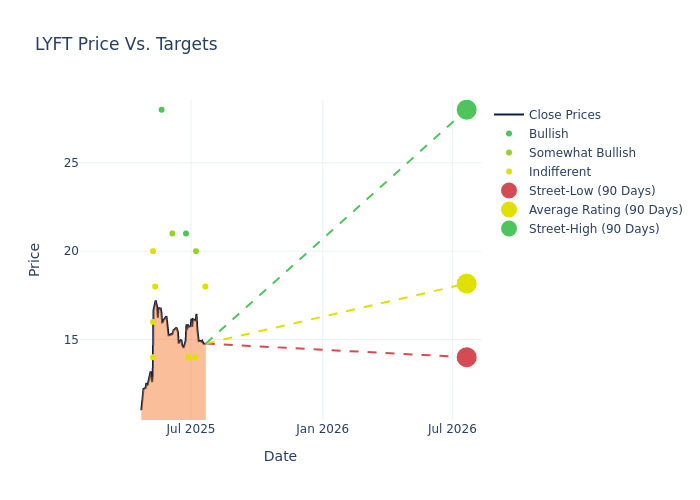

In the assessment of 12-month price targets, analysts unveil insights for Lyft, presenting an average target of $18.08, a high estimate of $28.00, and a low estimate of $14.00. This upward trend is apparent, with the current average reflecting a 3.08% increase from the previous average price target of $17.54.

Understanding Analyst Ratings: A Comprehensive Breakdown

The perception of Lyft by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Nikhil Devnani | Bernstein | Raises | Market Perform | $18.00 | $16.00 |

| Chad Larkin | Oppenheimer | Raises | Outperform | $20.00 | $17.00 |

| Ken Gawrelski | Wells Fargo | Raises | Equal-Weight | $14.00 | $13.00 |

| George Gianarikas | Canaccord Genuity | Lowers | Hold | $14.00 | $22.00 |

| George Gianarikas | Citigroup | Lowers | Hold | $14.00 | $22.00 |

| John Blackledge | TD Cowen | Raises | Buy | $21.00 | $16.00 |

| Brad Erickson | RBC Capital | Maintains | Outperform | $21.00 | $21.00 |

| Ivan Feinseth | Tigress Financial | Raises | Buy | $28.00 | $26.00 |

| Shyam Patil | Susquehanna | Raises | Neutral | $18.00 | $15.00 |

| Stephen Ju | UBS | Raises | Neutral | $14.00 | $12.00 |

| Doug Anmuth | JP Morgan | Raises | Neutral | $16.00 | $14.00 |

| Jason Helfstein | Oppenheimer | Raises | Outperform | $17.00 | $15.00 |

| Ross Sandler | Barclays | Raises | Equal-Weight | $20.00 | $19.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Lyft. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Lyft compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Lyft's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Lyft's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Lyft analyst ratings.

Unveiling the Story Behind Lyft

Lyft is the second-largest ride-sharing service provider in the US and Canada, connecting riders and drivers over the Lyft app. Incorporated in 2013 and public since 2019, Lyft offers a variety of rides via private vehicles, including traditional private rides, shared rides, and luxury ones. Besides ride-share, Lyft has entered the bike- and scooter-share market to bring multimodal transportation options to users.

Lyft's Economic Impact: An Analysis

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Positive Revenue Trend: Examining Lyft's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 13.54% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Lyft's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 0.18%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Lyft's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 0.32%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Lyft's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.05%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Lyft's debt-to-equity ratio surpasses industry norms, standing at 1.41. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Analyst Ratings: What Are They?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for LYFT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Loop Capital | Maintains | Buy | |

| Mar 2022 | Deutsche Bank | Initiates Coverage On | Hold | |

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings