The Analyst Verdict: VF In The Eyes Of 17 Experts

In the preceding three months, 17 analysts have released ratings for VF (NYSE:VFC), presenting a wide array of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 13 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 2 | 12 | 0 | 0 |

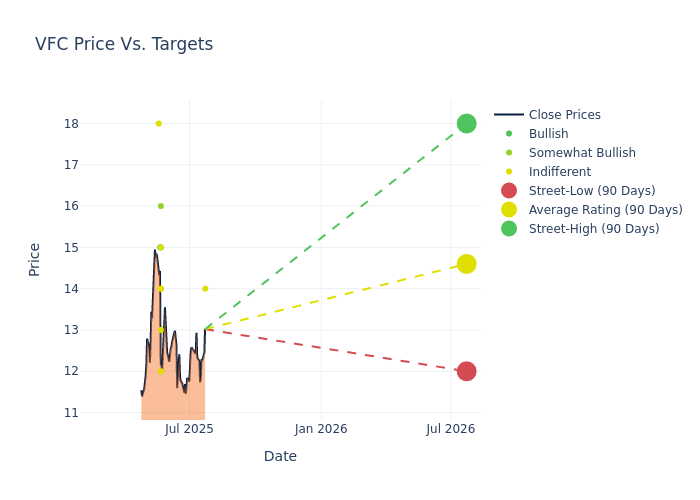

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $14.94, with a high estimate of $19.00 and a low estimate of $12.00. Observing a downward trend, the current average is 26.58% lower than the prior average price target of $20.35.

Investigating Analyst Ratings: An Elaborate Study

The standing of VF among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Dana Telsey | Telsey Advisory Group | Maintains | Market Perform | $14.00 | $14.00 |

| Dana Telsey | Telsey Advisory Group | Lowers | Market Perform | $14.00 | $17.00 |

| Adrienne Yih | Barclays | Lowers | Overweight | $16.00 | $19.00 |

| Jonathan Komp | Baird | Lowers | Neutral | $14.00 | $17.00 |

| Simeon Siegel | BMO Capital | Lowers | Market Perform | $15.00 | $25.00 |

| Jim Duffy | Stifel | Lowers | Buy | $15.00 | $28.00 |

| Joseph Civello | Truist Securities | Lowers | Hold | $13.00 | $24.00 |

| Ike Boruchow | Wells Fargo | Lowers | Equal-Weight | $12.00 | $13.00 |

| Jay Sole | UBS | Lowers | Neutral | $14.00 | $16.00 |

| Tom Nikic | Needham | Lowers | Buy | $15.00 | $28.00 |

| Dana Telsey | Telsey Advisory Group | Maintains | Market Perform | $17.00 | $17.00 |

| Matthew Boss | JP Morgan | Lowers | Neutral | $18.00 | $25.00 |

| Jay Sole | UBS | Raises | Neutral | $16.00 | $12.00 |

| Ike Boruchow | Wells Fargo | Raises | Equal-Weight | $13.00 | $12.00 |

| Dana Telsey | Telsey Advisory Group | Lowers | Market Perform | $17.00 | $27.00 |

| Adrienne Yih | Barclays | Lowers | Overweight | $19.00 | $34.00 |

| Ike Boruchow | Wells Fargo | Lowers | Equal-Weight | $12.00 | $18.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to VF. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of VF compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

For valuable insights into VF's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on VF analyst ratings.

Discovering VF: A Closer Look

VF designs, produces, and distributes branded apparel, footwear, and accessories. Its apparel categories are active, outdoor, and work. Its portfolio of 11 brands includes Vans, The North Face, Timberland, Altra, and Dickies. VF markets its products in the Americas, Europe, and Asia-Pacific through wholesale sales to retailers, e-commerce, and branded stores owned by the company and partners. Tracing its roots to 1899, the company has evolved through many brand acquisitions and dispositions.

Unraveling the Financial Story of VF

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: VF's revenue growth over a period of 3M has faced challenges. As of 31 March, 2025, the company experienced a revenue decline of approximately -4.61%. This indicates a decrease in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: VF's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -7.03%, the company may face hurdles in effective cost management.

Return on Equity (ROE): VF's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -9.52%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): VF's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -1.51%, the company may face hurdles in achieving optimal financial returns.

Debt Management: VF's debt-to-equity ratio is below the industry average. With a ratio of 3.61, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: Simplified

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for VFC

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Truist Securities | Maintains | Hold | |

| Jan 2022 | Deutsche Bank | Maintains | Buy | |

| Jan 2022 | Barclays | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings