Demystifying SAP: Insights From 4 Analyst Reviews

In the preceding three months, 4 analysts have released ratings for SAP (NYSE:SAP), presenting a wide array of perspectives from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 2 | 0 | 0 | 0 |

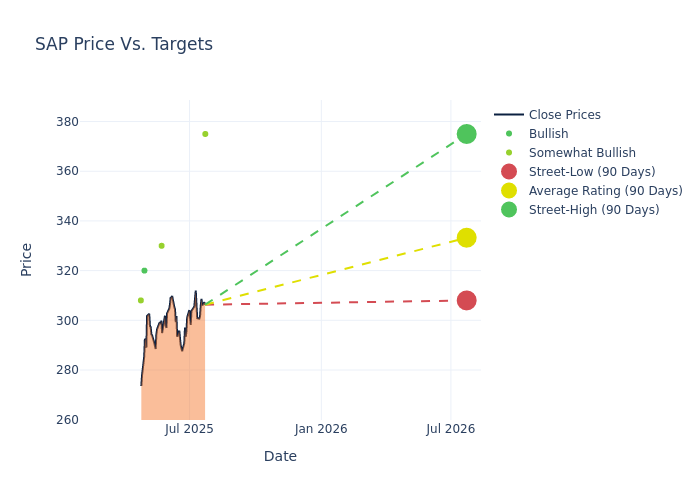

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $338.75, along with a high estimate of $375.00 and a low estimate of $320.00. Surpassing the previous average price target of $325.00, the current average has increased by 4.23%.

Breaking Down Analyst Ratings: A Detailed Examination

The perception of SAP by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Patrick Walravens | JMP Securities | Raises | Market Outperform | $375.00 | $330.00 |

| Keith Bachman | BMO Capital | Raises | Outperform | $330.00 | $320.00 |

| Patrick Walravens | JMP Securities | Maintains | Market Outperform | $330.00 | $330.00 |

| Joseph Bonner | Argus Research | Maintains | Buy | $320.00 | $320.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to SAP. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of SAP compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of SAP's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on SAP analyst ratings.

Discovering SAP: A Closer Look

Founded in Germany in 1972 by former IBM employees, SAP is the world's largest provider of enterprise application software. Known as the leader in enterprise resource planning software, SAP's portfolio also includes software for supply chain management, procurement, travel and expense management, and customer relationship management, among others. The company operates in more than 180 countries and has more than 400,000 customers, approximately 80% of which are small to medium-size enterprises.

SAP: Financial Performance Dissected

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Positive Revenue Trend: Examining SAP's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 12.09% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: SAP's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 19.75%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): SAP's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 3.91%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): SAP's ROA excels beyond industry benchmarks, reaching 2.38%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.22, SAP adopts a prudent financial strategy, indicating a balanced approach to debt management.

What Are Analyst Ratings?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for SAP

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Cowen & Co. | Maintains | Market Perform | |

| Dec 2021 | UBS | Upgrades | Neutral | Buy |

| Nov 2021 | RBC Capital | Maintains | Outperform |

Posted-In: BZI-AARAnalyst Ratings