9 Analysts Have This To Say About nVent Electric

Throughout the last three months, 9 analysts have evaluated nVent Electric (NYSE:NVT), offering a diverse set of opinions from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 6 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 2 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 3 | 0 | 0 | 0 |

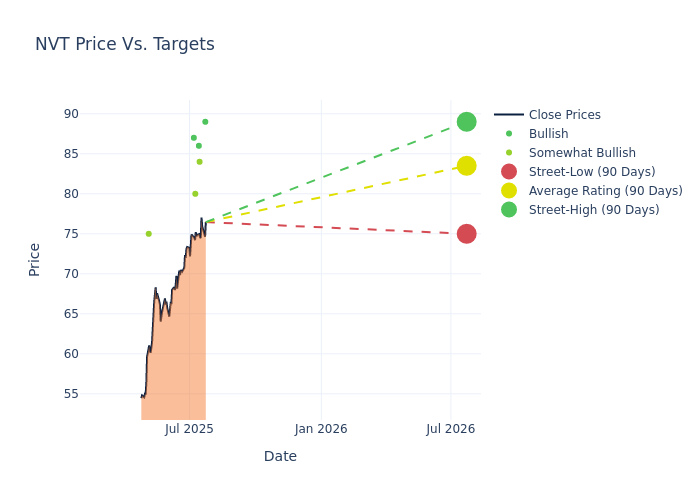

The 12-month price targets, analyzed by analysts, offer insights with an average target of $79.67, a high estimate of $89.00, and a low estimate of $70.00. This current average has increased by 12.4% from the previous average price target of $70.88.

Analyzing Analyst Ratings: A Detailed Breakdown

A clear picture of nVent Electric's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Justin Clare | Roth Capital | Announces | Buy | $89.00 | - |

| Ken Newman | Keybanc | Raises | Overweight | $84.00 | $78.00 |

| Vladimir Bystricky | Citigroup | Raises | Buy | $86.00 | $69.00 |

| Julian Mitchell | Barclays | Raises | Overweight | $80.00 | $74.00 |

| Joe Ritchie | Goldman Sachs | Raises | Buy | $87.00 | $78.00 |

| Julian Mitchell | Barclays | Raises | Overweight | $74.00 | $70.00 |

| Julian Mitchell | Barclays | Raises | Overweight | $70.00 | $65.00 |

| Deane Dray | RBC Capital | Raises | Outperform | $75.00 | $73.00 |

| Jefferson Harralson | Keybanc | Raises | Overweight | $72.00 | $60.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to nVent Electric. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of nVent Electric compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for nVent Electric's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

For valuable insights into nVent Electric's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on nVent Electric analyst ratings.

Delving into nVent Electric's Background

nVent is a leading global provider of electrical connection and protection solutions that touches a broad range of end markets including infrastructure, industrial, commercial, and residential. NVent designs, manufacturers, markets, installs, and services a portfolio of electrical enclosures and electrical fastening solutions. North America accounts for the majority of sales.

nVent Electric: Delving into Financials

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Positive Revenue Trend: Examining nVent Electric's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 10.54% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: nVent Electric's net margin is impressive, surpassing industry averages. With a net margin of 44.57%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): nVent Electric's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 10.53%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): nVent Electric's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 5.36% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: nVent Electric's debt-to-equity ratio is below the industry average. With a ratio of 0.52, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Understanding the Relevance of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for NVT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Barclays | Maintains | Overweight | |

| Jan 2022 | Vertical Research | Upgrades | Hold | Buy |

| Oct 2021 | Keybanc | Maintains | Overweight |

Posted-In: BZI-AARAnalyst Ratings