A Glimpse Into The Expert Outlook On Extra Space Storage Through 9 Analysts

In the last three months, 9 analysts have published ratings on Extra Space Storage (NYSE:EXR), offering a diverse range of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 1 | 2 | 3 | 0 | 0 |

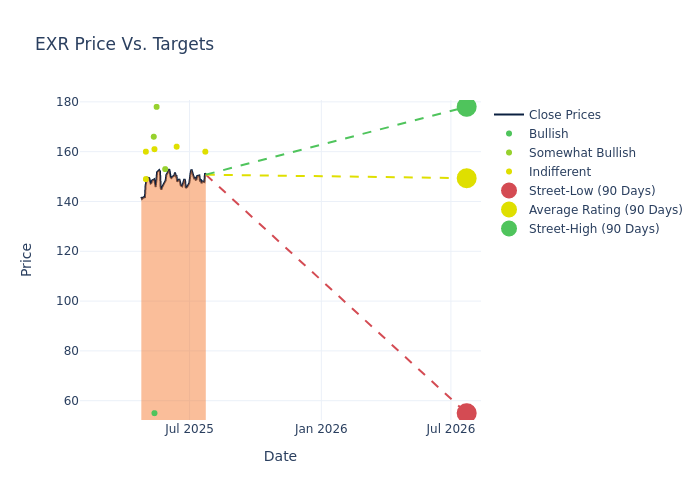

Insights from analysts' 12-month price targets are revealed, presenting an average target of $149.33, a high estimate of $178.00, and a low estimate of $55.00. Observing a 1.89% increase, the current average has risen from the previous average price target of $146.56.

Diving into Analyst Ratings: An In-Depth Exploration

A comprehensive examination of how financial experts perceive Extra Space Storage is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Eric Luebchow | Wells Fargo | Lowers | Equal-Weight | $160.00 | $165.00 |

| Michael Mueller | JP Morgan | Raises | Neutral | $162.00 | $160.00 |

| Ravi Vaidya | Mizuho | Raises | Outperform | $153.00 | $141.00 |

| Brendan Lynch | Barclays | Lowers | Overweight | $178.00 | $181.00 |

| Mark Zgutowicz | Benchmark | Lowers | Buy | $55.00 | $61.00 |

| Jeffrey Spector | B of A Securities | Raises | Neutral | $161.00 | $155.00 |

| Nicholas Yulico | Scotiabank | Raises | Sector Outperform | $166.00 | $149.00 |

| Brad Heffern | RBC Capital | Lowers | Sector Perform | $160.00 | $163.00 |

| Steve Sakwa | Evercore ISI Group | Raises | In-Line | $149.00 | $144.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Extra Space Storage. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Extra Space Storage compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Extra Space Storage's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Extra Space Storage's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Extra Space Storage analyst ratings.

Discovering Extra Space Storage: A Closer Look

Extra Space Storage is a fully integrated real estate investment trust that owns, operates, and manages almost 4,000 self-storage properties in 42 states, with over 300 million net rentable square feet of storage space. Of these properties, approximately one half is wholly owned, while some facilities are owned through joint ventures and others are owned by third parties and managed by Extra Space Storage in exchange for a management fee.

Extra Space Storage: Financial Performance Dissected

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Extra Space Storage's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 2.56%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Real Estate sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 32.98%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 1.94%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Extra Space Storage's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.94% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.95.

Understanding the Relevance of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for EXR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Morgan Stanley | Maintains | Underweight | |

| Jan 2022 | Jefferies | Downgrades | Buy | Hold |

| Dec 2021 | JP Morgan | Downgrades | Overweight | Neutral |

Posted-In: BZI-AARAnalyst Ratings