Demystifying BankUnited: Insights From 8 Analyst Reviews

8 analysts have expressed a variety of opinions on BankUnited (NYSE:BKU) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 7 | 0 | 1 |

| Last 30D | 0 | 0 | 2 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 3 | 0 | 1 |

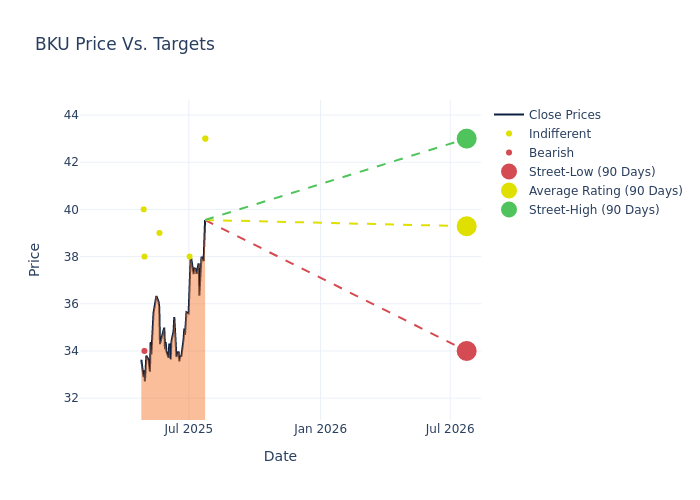

Insights from analysts' 12-month price targets are revealed, presenting an average target of $39.5, a high estimate of $43.00, and a low estimate of $34.00. This upward trend is evident, with the current average reflecting a 0.18% increase from the previous average price target of $39.43.

Exploring Analyst Ratings: An In-Depth Overview

The standing of BankUnited among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Stephen Scouten | Piper Sandler | Raises | Neutral | $43.00 | $41.00 |

| Jared Shaw | Barclays | Raises | Equal-Weight | $43.00 | $41.00 |

| Jared Shaw | Barclays | Raises | Equal-Weight | $41.00 | $38.00 |

| Benjamin Gerlinger | Citigroup | Raises | Neutral | $38.00 | $36.00 |

| David Chiaverini | Jefferies | Announces | Hold | $39.00 | - |

| Ryan Nash | Goldman Sachs | Lowers | Sell | $34.00 | $38.00 |

| Wood Lay | Keefe, Bruyette & Woods | Lowers | Market Perform | $38.00 | $40.00 |

| Jon Arfstrom | RBC Capital | Lowers | Sector Perform | $40.00 | $42.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to BankUnited. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of BankUnited compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for BankUnited's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of BankUnited's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on BankUnited analyst ratings.

Discovering BankUnited: A Closer Look

BankUnited Inc is a bank holding company with one wholly owned subsidiary, BankUnited. The bank provides a full range of banking services through banking centers located throughout Florida, as well as New York City. The company is a commercially focused regional bank focusing on small and middle-market businesses, but also provides certain commercial lending and deposit products on a national platform. The Bank offers a comprehensive suite of commercial lending and deposit products through an Atlanta office focused on the Southeast region, certain commercial lending and deposit products through national platforms and certain consumer deposit products through an online channel.

BankUnited: A Financial Overview

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: BankUnited displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 5.66%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 22.57%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): BankUnited's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 2.02%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): BankUnited's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.16%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: BankUnited's debt-to-equity ratio stands notably higher than the industry average, reaching 1.07. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Core of Analyst Ratings: What Every Investor Should Know

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for BKU

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Dec 2021 | Morgan Stanley | Maintains | Equal-Weight | |

| Oct 2021 | RBC Capital | Downgrades | Outperform | Sector Perform |

| Oct 2021 | Piper Sandler | Downgrades | Overweight | Neutral |

Posted-In: BZI-AARAnalyst Ratings