Where Parsons Stands With Analysts

In the last three months, 10 analysts have published ratings on Parsons (NYSE:PSN), offering a diverse range of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 1 | 3 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 1 | 1 | 0 | 0 |

| 2M Ago | 2 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 2 | 0 | 0 |

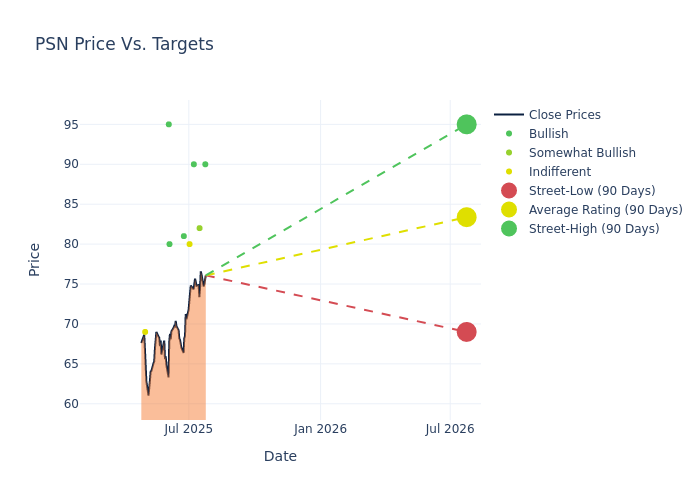

In the assessment of 12-month price targets, analysts unveil insights for Parsons, presenting an average target of $81.2, a high estimate of $95.00, and a low estimate of $65.00. Witnessing a positive shift, the current average has risen by 3.11% from the previous average price target of $78.75.

Exploring Analyst Ratings: An In-Depth Overview

The perception of Parsons by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Tobey Sommer | Truist Securities | Raises | Buy | $90.00 | $80.00 |

| Eric Heath | Keybanc | Raises | Overweight | $82.00 | $73.00 |

| Brian Gesuale | Raymond James | Announces | Strong Buy | $90.00 | - |

| Sheila Kahyaoglu | Jefferies | Raises | Hold | $80.00 | $70.00 |

| Jonathan Siegmann | Stifel | Announces | Buy | $81.00 | - |

| Noah Poponak | Goldman Sachs | Lowers | Buy | $80.00 | $90.00 |

| Ronald Epstein | B of A Securities | Lowers | Buy | $95.00 | $100.00 |

| Sheila Kahyaoglu | Jefferies | Lowers | Hold | $65.00 | $75.00 |

| Tobey Sommer | Truist Securities | Raises | Buy | $80.00 | $70.00 |

| Andrew Wittmann | Baird | Lowers | Neutral | $69.00 | $72.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Parsons. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Parsons compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Parsons's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Parsons's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Parsons analyst ratings.

All You Need to Know About Parsons

Parsons Corp is a provider of technology-driven solutions in the defense, intelligence, and critical infrastructure markets. The business activities of the group are carried out through Federal Solutions and Critical Infrastructure segments. The Federal Solutions segment is a high-end service and technology provider to the U.S. government, delivering timely, cost-effective solutions for mission-critical projects, whereas the Critical Infrastructure segment provides integrated design and engineering services for complex physical and digital infrastructure around the globe.

Parsons: Financial Performance Dissected

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Over the 3M period, Parsons showcased positive performance, achieving a revenue growth rate of 1.22% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: Parsons's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 4.26%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Parsons's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 2.72%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 1.21%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Parsons's debt-to-equity ratio is below the industry average at 0.56, reflecting a lower dependency on debt financing and a more conservative financial approach.

Understanding the Relevance of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for PSN

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | B of A Securities | Upgrades | Underperform | Neutral |

| Mar 2022 | Raymond James | Initiates Coverage On | Outperform | |

| Dec 2021 | William Blair | Downgrades | Outperform | Market Perform |

Posted-In: BZI-AARAnalyst Ratings