Expert Outlook: Genuine Parts Through The Eyes Of 4 Analysts

Genuine Parts (NYSE:GPC) has been analyzed by 4 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 1 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

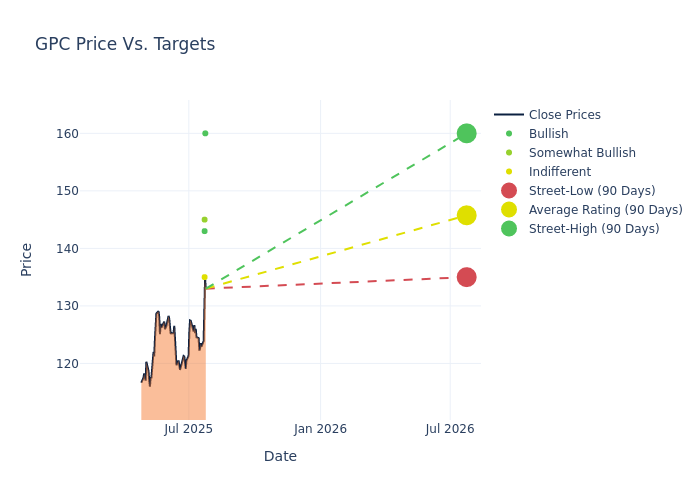

Analysts have recently evaluated Genuine Parts and provided 12-month price targets. The average target is $145.75, accompanied by a high estimate of $160.00 and a low estimate of $135.00. Observing a 5.81% increase, the current average has risen from the previous average price target of $137.75.

Interpreting Analyst Ratings: A Closer Look

The perception of Genuine Parts by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Chris Dankert | Loop Capital | Raises | Buy | $160.00 | $155.00 |

| Michael Lasser | UBS | Raises | Neutral | $135.00 | $125.00 |

| Christopher Horvers | JP Morgan | Raises | Overweight | $145.00 | $134.00 |

| Scot Ciccarelli | Truist Securities | Raises | Buy | $143.00 | $137.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Genuine Parts. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Genuine Parts compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Genuine Parts's stock. This analysis reveals shifts in analysts' expectations over time.

Capture valuable insights into Genuine Parts's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Genuine Parts analyst ratings.

Delving into Genuine Parts's Background

Genuine Parts sells aftermarket automotive parts (60% of sales) and industrial products (40% of sales) in the United States and internationally. The automotive segment primarily acts as a distributor to its network of 9,800 global retail locations of which about two thirds are independently owned and operated. We estimate Genuine serves around 6,000 retail locations in the US operating under the Napa Auto Parts brand, with about 80% of end-market sales derived from professional customers. Its industrial segment, primarily operating under the Motion banner in the United States, is a leading distributor of bearings, power transmission, and other industrial products to more than 200,000 maintenance, repair, and original equipment manufacturer customers.

Genuine Parts's Financial Performance

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Positive Revenue Trend: Examining Genuine Parts's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 3.39% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: Genuine Parts's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.13% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Genuine Parts's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 5.57%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Genuine Parts's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.27%, the company showcases efficient use of assets and strong financial health.

Debt Management: Genuine Parts's debt-to-equity ratio stands notably higher than the industry average, reaching 1.37. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Significance of Analyst Ratings Explained

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for GPC

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Truist Securities | Initiates Coverage On | Hold | |

| Oct 2021 | Stephens & Co. | Maintains | Equal-Weight | |

| May 2021 | Goldman Sachs | Upgrades | Sell | Neutral |

Posted-In: BZI-AARAnalyst Ratings