Analyst Expectations For Honeywell Intl's Future

In the last three months, 15 analysts have published ratings on Honeywell Intl (NASDAQ:HON), offering a diverse range of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 4 | 8 | 0 | 0 |

| Last 30D | 0 | 0 | 2 | 0 | 0 |

| 1M Ago | 0 | 1 | 2 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 2 | 2 | 4 | 0 | 0 |

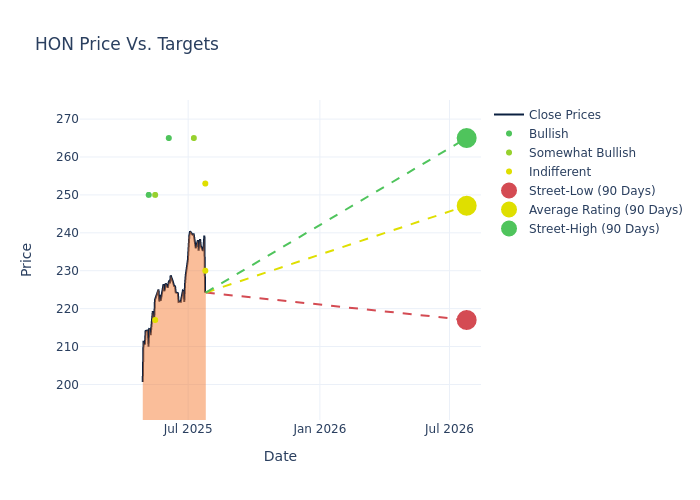

Insights from analysts' 12-month price targets are revealed, presenting an average target of $238.13, a high estimate of $265.00, and a low estimate of $182.00. Observing a 5.52% increase, the current average has risen from the previous average price target of $225.67.

Understanding Analyst Ratings: A Comprehensive Breakdown

A comprehensive examination of how financial experts perceive Honeywell Intl is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Deane Dray | RBC Capital | Lowers | Sector Perform | $253.00 | $254.00 |

| Joseph O'Dea | Wells Fargo | Lowers | Equal-Weight | $230.00 | $240.00 |

| Julian Mitchell | Barclays | Raises | Overweight | $265.00 | $258.00 |

| Joseph O'Dea | Wells Fargo | Raises | Equal-Weight | $240.00 | $225.00 |

| Deane Dray | RBC Capital | Maintains | Sector Perform | $226.00 | $226.00 |

| Julian Mitchell | Barclays | Raises | Overweight | $258.00 | $243.00 |

| Andrew Kaplowitz | Citigroup | Raises | Buy | $265.00 | $242.00 |

| Brett Linzey | Mizuho | Raises | Outperform | $250.00 | $235.00 |

| Stephen Tusa | JP Morgan | Raises | Neutral | $217.00 | $182.00 |

| Andrew Obin | B of A Securities | Raises | Buy | $250.00 | $210.00 |

| Andrew Kaplowitz | Citigroup | Raises | Buy | $242.00 | $229.00 |

| Stephen Tusa | JP Morgan | Raises | Neutral | $182.00 | $178.00 |

| Joseph O'Dea | Wells Fargo | Raises | Equal-Weight | $225.00 | $205.00 |

| Deane Dray | RBC Capital | Raises | Sector Perform | $226.00 | $211.00 |

| Julian Mitchell | Barclays | Lowers | Overweight | $243.00 | $247.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Honeywell Intl. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Honeywell Intl compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Honeywell Intl's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Honeywell Intl's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Honeywell Intl analyst ratings.

Get to Know Honeywell Intl Better

Honeywell traces its roots to 1885 with Albert Butz's firm, Butz Thermo-Electric Regulator, which produced a predecessor to the modern thermostat. Other inventions by Honeywell include biodegradable detergent and autopilot. Today, Honeywell is a global multi-industry behemoth with one of the largest installed bases of equipment. It operates through four business segments: aerospace technologies (37% of 2023 company revenue), industrial automation (29%), energy and sustainability solutions (17%), and building automation (17%). Recently, Honeywell has made several portfolio changes to focus on fewer end markets and align with a set of secular growth trends. The firm is working diligently to expand its installed base, deriving around 30% of its revenue from recurring aftermarket services.

Breaking Down Honeywell Intl's Financial Performance

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Honeywell Intl's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 7.87%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Honeywell Intl's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 14.75% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Honeywell Intl's ROE stands out, surpassing industry averages. With an impressive ROE of 8.03%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Honeywell Intl's ROA excels beyond industry benchmarks, reaching 1.93%. This signifies efficient management of assets and strong financial health.

Debt Management: Honeywell Intl's debt-to-equity ratio is below the industry average at 1.88, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Significance of Analyst Ratings Explained

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for HON

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Deutsche Bank | Maintains | Buy | |

| Feb 2022 | UBS | Maintains | Buy | |

| Feb 2022 | Wells Fargo | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings