Breaking Down Colgate-Palmolive: 5 Analysts Share Their Views

In the latest quarter, 5 analysts provided ratings for Colgate-Palmolive (NYSE:CL), showcasing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 0 | 0 | 0 |

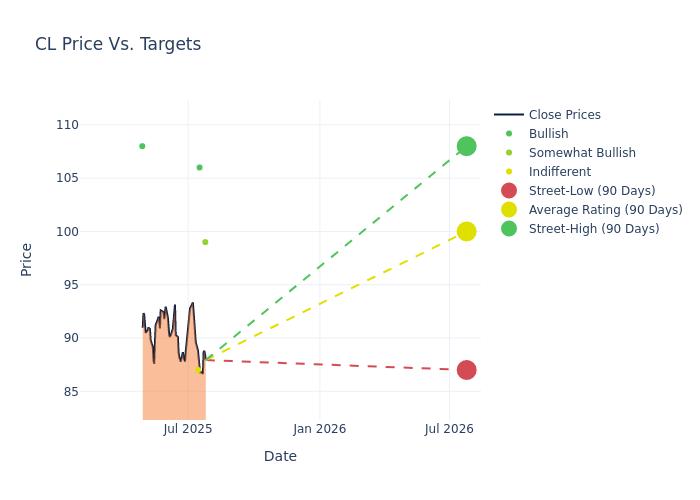

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $100.6, along with a high estimate of $108.00 and a low estimate of $87.00. This upward trend is apparent, with the current average reflecting a 1.41% increase from the previous average price target of $99.20.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Colgate-Palmolive among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Andrea Teixeira | JP Morgan | Lowers | Overweight | $99.00 | $103.00 |

| Peter Grom | UBS | Lowers | Buy | $106.00 | $109.00 |

| Lauren Lieberman | Barclays | Raises | Equal-Weight | $87.00 | $86.00 |

| Filippo Falorni | Citigroup | Raises | Buy | $108.00 | $103.00 |

| Andrea Teixeira | JP Morgan | Raises | Overweight | $103.00 | $95.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Colgate-Palmolive. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Colgate-Palmolive compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Colgate-Palmolive's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Colgate-Palmolive's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Colgate-Palmolive analyst ratings.

Get to Know Colgate-Palmolive Better

Since its founding in 1806, Colgate-Palmolive has grown to become a leading player in the household and personal care arena. In addition to its namesake oral care line (which accounts for north of 40% of its total sales), the firm manufactures shampoos, shower gels, deodorants, and homecare products that are sold in over 200 countries. International sales account for about 70% of its total business, including approximately 45% from emerging regions. It also owns specialty pet food maker Hill's (around one fifth of sales), which sells a majority of its products through veterinarians and specialty pet retailers.

Understanding the Numbers: Colgate-Palmolive's Finances

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Negative Revenue Trend: Examining Colgate-Palmolive's financials over 3M reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -3.04% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Consumer Staples sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 14.05%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Colgate-Palmolive's ROE excels beyond industry benchmarks, reaching 240.0%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 4.22%, the company showcases effective utilization of assets.

Debt Management: Colgate-Palmolive's debt-to-equity ratio stands notably higher than the industry average, reaching 22.78. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Analyst Ratings: What Are They?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for CL

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Bernstein | Upgrades | Underperform | Market Perform |

| Jan 2022 | Credit Suisse | Maintains | Outperform | |

| Jan 2022 | Morgan Stanley | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings