Where Sunstone Hotel Invts Stands With Analysts

Across the recent three months, 4 analysts have shared their insights on Sunstone Hotel Invts (NYSE:SHO), expressing a variety of opinions spanning from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 1 | 1 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 1 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

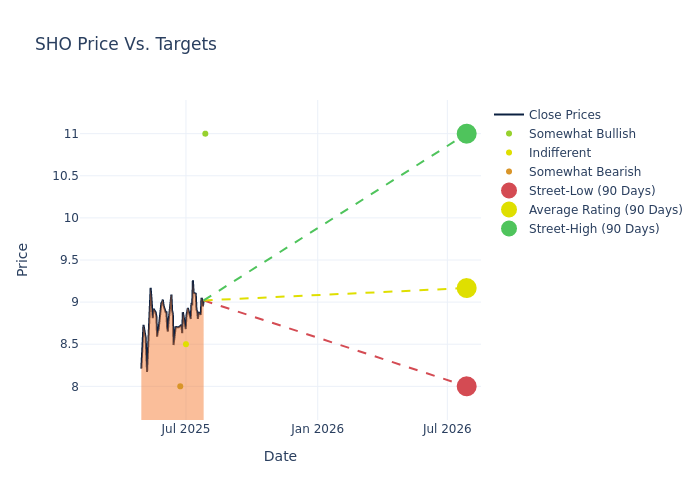

The 12-month price targets, analyzed by analysts, offer insights with an average target of $9.38, a high estimate of $11.00, and a low estimate of $8.00. Highlighting a 3.0% decrease, the current average has fallen from the previous average price target of $9.67.

Interpreting Analyst Ratings: A Closer Look

In examining recent analyst actions, we gain insights into how financial experts perceive Sunstone Hotel Invts. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Duane Pfenningwerth | Evercore ISI Group | Raises | Outperform | $11.00 | $10.00 |

| James Feldman | Wells Fargo | Lowers | Equal-Weight | $8.50 | $9.00 |

| Daniel Politzer | JP Morgan | Announces | Underweight | $8.00 | - |

| Duane Pfenningwerth | Evercore ISI Group | Maintains | Outperform | $10.00 | $10.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Sunstone Hotel Invts. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Sunstone Hotel Invts compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Sunstone Hotel Invts's stock. This analysis reveals shifts in analysts' expectations over time.

For valuable insights into Sunstone Hotel Invts's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Sunstone Hotel Invts analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Unveiling the Story Behind Sunstone Hotel Invts

Sunstone Hotel Investors Inc is a real estate investment trust that acquires, owns, manages, and renovates the full-service hotel and select-service hotel properties across various states in the United States. Its firm's portfolio consists upper upscale and luxury hotels located in convention, resort destination and urban markets. Its majority of the hotels operate under a brand owned by Marriott, Hilton, Hyatt, Four Seasons or Montage. It operates geographically in Califiornia which generates the majority of its revenue; Florida; and Hawaii. The company's sole source of income is hotel revenue from its hotel ownership segment.

Sunstone Hotel Invts: Delving into Financials

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3M period, Sunstone Hotel Invts showcased positive performance, achieving a revenue growth rate of 7.78% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Real Estate sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Sunstone Hotel Invts's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 0.54%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Sunstone Hotel Invts's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 0.07%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Sunstone Hotel Invts's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.04%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Sunstone Hotel Invts's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.47.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for SHO

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Evercore ISI Group | Upgrades | In-Line | Outperform |

| Mar 2022 | Barclays | Downgrades | Overweight | Underweight |

| Jan 2022 | Morgan Stanley | Upgrades | Equal-Weight | Overweight |

Posted-In: BZI-AARAnalyst Ratings