A Glimpse Into The Expert Outlook On Broadstone Net Lease Through 6 Analysts

During the last three months, 6 analysts shared their evaluations of Broadstone Net Lease (NYSE:BNL), revealing diverse outlooks from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 3 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 2 | 0 | 0 |

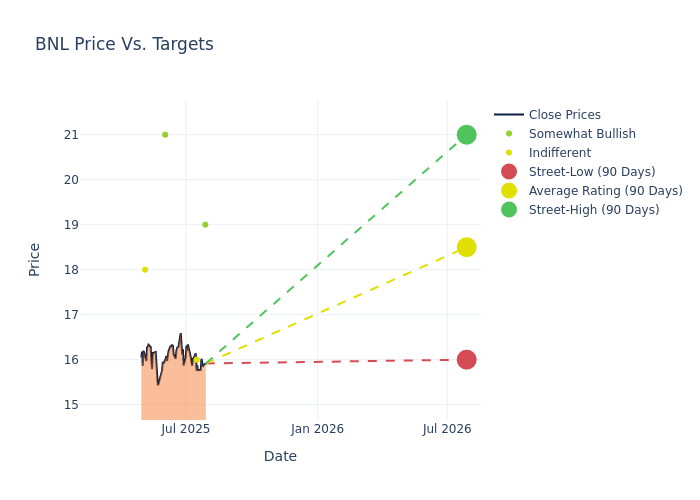

Analysts have recently evaluated Broadstone Net Lease and provided 12-month price targets. The average target is $18.67, accompanied by a high estimate of $21.00 and a low estimate of $16.00. Experiencing a 0.69% decline, the current average is now lower than the previous average price target of $18.80.

Deciphering Analyst Ratings: An In-Depth Analysis

A comprehensive examination of how financial experts perceive Broadstone Net Lease is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Andrew Rosivach | Wolfe Research | Announces | Outperform | $19.00 | - |

| Michael Goldsmith | UBS | Lowers | Neutral | $16.00 | $17.00 |

| Mitch Germain | JMP Securities | Maintains | Market Outperform | $21.00 | $21.00 |

| Michael Goldsmith | UBS | Lowers | Neutral | $17.00 | $18.00 |

| Ki Bin Kim | Truist Securities | Raises | Hold | $18.00 | $17.00 |

| Mitch Germain | JMP Securities | Maintains | Market Outperform | $21.00 | $21.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Broadstone Net Lease. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Broadstone Net Lease compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Capture valuable insights into Broadstone Net Lease's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Broadstone Net Lease analyst ratings.

Get to Know Broadstone Net Lease Better

Broadstone Net Lease Inc is an internally managed real estate investment trust that invests in, owns, and manages single-tenant commercial real estate properties that are net leased on a long-term basis to a diversified group of tenants. The company has selectively invested in net leased assets in the industrial, healthcare, restaurant, retail, and office property types. The company focuses on investing in real estate that is operated by creditworthy single tenants in industries characterized by positive business drivers and trends. The company targets properties that are an integral part of the tenants' businesses and are therefore opportunities to secure long-term net leases.

Broadstone Net Lease: Financial Performance Dissected

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: Broadstone Net Lease displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 3.15%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Real Estate sector.

Net Margin: Broadstone Net Lease's net margin is impressive, surpassing industry averages. With a net margin of 15.12%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Broadstone Net Lease's ROE excels beyond industry benchmarks, reaching 0.55%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Broadstone Net Lease's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.31% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Broadstone Net Lease's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.69.

Understanding the Relevance of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for BNL

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Sep 2021 | Morgan Stanley | Maintains | Equal-Weight | |

| Aug 2021 | Truist Securities | Downgrades | Buy | Hold |

| Jun 2021 | Goldman Sachs | Downgrades | Buy | Neutral |

Posted-In: BZI-AARAnalyst Ratings