14 Analysts Assess Tapestry: What You Need To Know

During the last three months, 14 analysts shared their evaluations of Tapestry (NYSE:TPR), revealing diverse outlooks from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 10 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 2 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 7 | 1 | 0 | 0 |

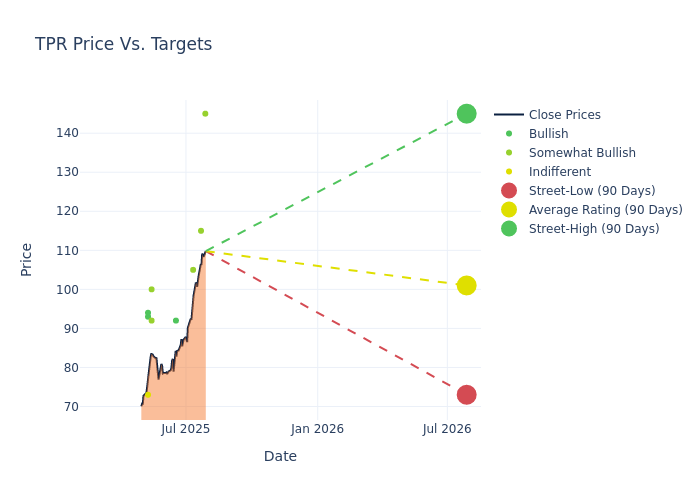

Analysts have set 12-month price targets for Tapestry, revealing an average target of $97.21, a high estimate of $145.00, and a low estimate of $73.00. This current average has increased by 11.47% from the previous average price target of $87.21.

Investigating Analyst Ratings: An Elaborate Study

An in-depth analysis of recent analyst actions unveils how financial experts perceive Tapestry. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Matthew Boss | JP Morgan | Raises | Overweight | $145.00 | $104.00 |

| Rick Patel | Raymond James | Raises | Outperform | $115.00 | $85.00 |

| Adrienne Yih | Barclays | Raises | Overweight | $105.00 | $98.00 |

| Christine Dooley | Argus Research | Raises | Buy | $92.00 | $78.00 |

| Ike Boruchow | Wells Fargo | Raises | Overweight | $100.00 | $90.00 |

| Dana Telsey | Telsey Advisory Group | Maintains | Outperform | $92.00 | $92.00 |

| Adrienne Yih | Barclays | Raises | Overweight | $98.00 | $83.00 |

| Jay Sole | UBS | Raises | Neutral | $73.00 | $68.00 |

| Brooke Roach | Goldman Sachs | Raises | Buy | $93.00 | $84.00 |

| Rick Patel | Raymond James | Raises | Outperform | $85.00 | $74.00 |

| Paul Lejuez | Citigroup | Raises | Buy | $94.00 | $81.00 |

| Dana Telsey | Telsey Advisory Group | Maintains | Outperform | $92.00 | $92.00 |

| Dana Telsey | Telsey Advisory Group | Maintains | Outperform | $92.00 | $92.00 |

| Ike Boruchow | Wells Fargo | Lowers | Overweight | $85.00 | $100.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Tapestry. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Tapestry compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Tapestry's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Tapestry's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Tapestry analyst ratings.

Delving into Tapestry's Background

Based in New York City, Tapestry is the parent company of accessories and fashion brand Coach, which accounts for about 80% of its sales and more than 90% of its operating profit. Coach products are sold through 900 company-owned stores, e-commerce, and third-party stores in North America, Asia, and Europe. Tapestry also owns Kate Spade, which generated 54% of its sales from handbags in fiscal 2024. Kate Spade is known for its colorful patterns and graphics. Meanwhile, Tapestry's smallest brand, luxury footwear maker Stuart Weitzman, is set to be sold to Caleres in the summer of 2025.

Tapestry's Financial Performance

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Tapestry's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 6.89%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: Tapestry's net margin excels beyond industry benchmarks, reaching 12.83%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Tapestry's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 14.37% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Tapestry's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 2.79%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 2.75.

Analyst Ratings: What Are They?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for TPR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Barclays | Maintains | Overweight | |

| Jan 2022 | Citigroup | Upgrades | Neutral | Buy |

| Nov 2021 | Argus Research | Upgrades | Hold | Buy |

Posted-In: BZI-AARAnalyst Ratings