A Glimpse Into The Expert Outlook On NeoGenomics Through 3 Analysts

NeoGenomics (NASDAQ:NEO) underwent analysis by 3 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 1 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

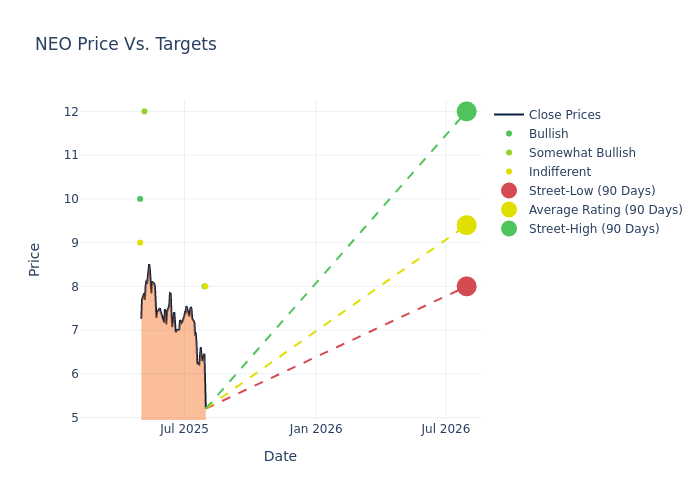

Insights from analysts' 12-month price targets are revealed, presenting an average target of $9.33, a high estimate of $12.00, and a low estimate of $8.00. A 23.34% drop is evident in the current average compared to the previous average price target of $12.17.

Decoding Analyst Ratings: A Detailed Look

A clear picture of NeoGenomics's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Tejas Savant | Morgan Stanley | Lowers | Equal-Weight | $8.00 | $10.00 |

| Mike Matson | Needham | Lowers | Buy | $8.00 | $8.50 |

| David Westenberg | Piper Sandler | Lowers | Overweight | $12.00 | $18.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to NeoGenomics. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of NeoGenomics compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for NeoGenomics's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of NeoGenomics's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on NeoGenomics analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Delving into NeoGenomics's Background

NeoGenomics Inc provides oncology diagnostic testing and consultative services which include technical laboratory services and professional interpretation of laboratory test results by licensed physicians or molecular experts in pathology and oncology. It operates a network of cancer-focused testing laboratories in the United States and the United Kingdom. The company operates in a single segment and derives revenue from clients by providing clinical cancer testing, interpretation, and consultative services, molecular and NGS testing, comprehensive technical and professional services offerings, clinical trials and research, validation laboratory services, and oncology data solutions.

Understanding the Numbers: NeoGenomics's Finances

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: NeoGenomics's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 7.55%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: NeoGenomics's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -15.43%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): NeoGenomics's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -2.9%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): NeoGenomics's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -1.6%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: NeoGenomics's debt-to-equity ratio is below the industry average. With a ratio of 0.68, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Core of Analyst Ratings: What Every Investor Should Know

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for NEO

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Feb 2022 | Needham | Maintains | Buy | |

| Feb 2022 | Raymond James | Maintains | Outperform |

Posted-In: BZI-AARAnalyst Ratings