5 Analysts Have This To Say About Chart Industries

In the latest quarter, 5 analysts provided ratings for Chart Industries (NYSE:GTLS), showcasing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 2 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 0 | 0 |

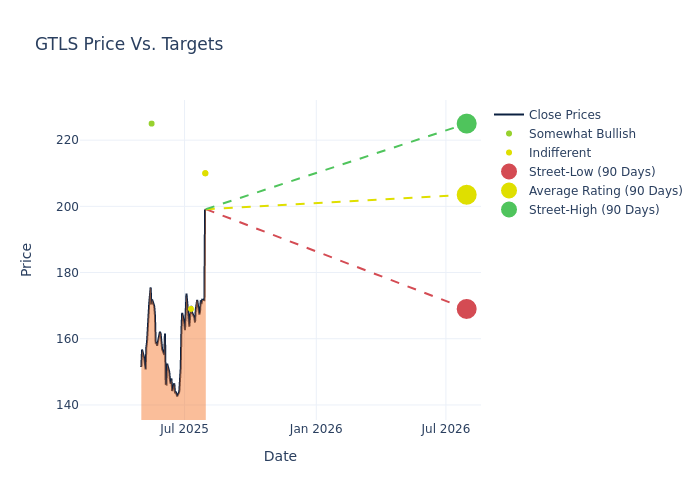

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $197.0, with a high estimate of $225.00 and a low estimate of $169.00. This current average represents a 2.23% decrease from the previous average price target of $201.50.

Deciphering Analyst Ratings: An In-Depth Analysis

The standing of Chart Industries among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Martin Malloy | Johnson Rice | Announces | Hold | $210.00 | - |

| Manav Gupta | UBS | Lowers | Neutral | $210.00 | $225.00 |

| David Anderson | Barclays | Lowers | Equal-Weight | $169.00 | $171.00 |

| Daniel Kutz | Morgan Stanley | Lowers | Overweight | $225.00 | $250.00 |

| David Anderson | Barclays | Raises | Equal-Weight | $171.00 | $160.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Chart Industries. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Chart Industries compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Chart Industries's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Chart Industries analyst ratings.

All You Need to Know About Chart Industries

Chart Industries provides a variety of cryogenic equipment for storage, distribution, and other processes within the industrial gas and liquefied natural gas industries. It also provides natural gas processing solutions for the natural gas industry and specialty products that serve a variety of spaces, including hydrogen, biofuels, cannabis, and water treatment. The firm acquired Howden in a significant deal in early 2023, roughly doubling the size of the company. It plans to merge with Flowserve by the end of 2025.

Chart Industries's Financial Performance

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Chart Industries displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 5.34%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: Chart Industries's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 4.26%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 1.47%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.46%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Chart Industries's debt-to-equity ratio surpasses industry norms, standing at 1.24. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Core of Analyst Ratings: What Every Investor Should Know

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for GTLS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | B of A Securities | Upgrades | Neutral | Buy |

| Mar 2022 | Barclays | Maintains | Overweight | |

| Feb 2022 | Wells Fargo | Maintains | Overweight |

Posted-In: BZI-AARAnalyst Ratings