Beyond The Numbers: 6 Analysts Discuss Regency Centers Stock

In the preceding three months, 6 analysts have released ratings for Regency Centers (NASDAQ:REG), presenting a wide array of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 2 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 1 | 0 | 0 |

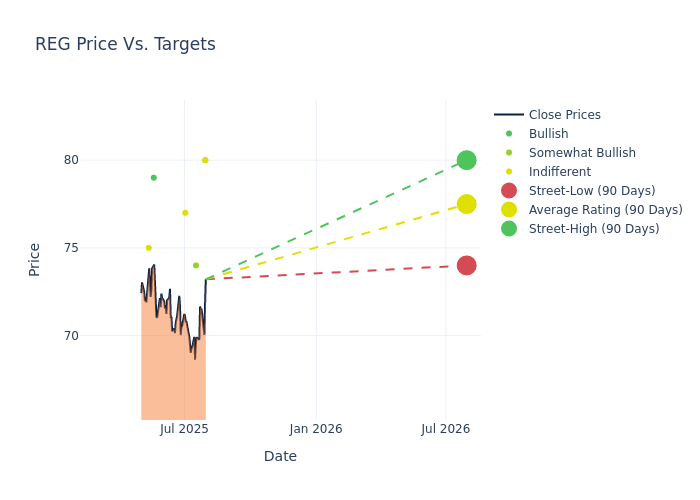

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $77.5, a high estimate of $80.00, and a low estimate of $74.00. A decline of 0.64% from the prior average price target is evident in the current average.

Diving into Analyst Ratings: An In-Depth Exploration

In examining recent analyst actions, we gain insights into how financial experts perceive Regency Centers. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Wesley Golladay | Baird | Raises | Outperform | $80.00 | $78.00 |

| Steve Sakwa | Evercore ISI Group | Raises | In-Line | $80.00 | $79.00 |

| Haendel St. Juste | Mizuho | Lowers | Outperform | $74.00 | $79.00 |

| Richard Hightower | Barclays | Announces | Equal-Weight | $77.00 | - |

| Ki Bin Kim | Truist Securities | Raises | Buy | $79.00 | $78.00 |

| Nicholas Yulico | Scotiabank | Lowers | Sector Perform | $75.00 | $76.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Regency Centers. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Regency Centers compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Regency Centers's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Regency Centers's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Regency Centers analyst ratings.

Unveiling the Story Behind Regency Centers

Regency Centers is one of the largest shopping center-focused retail REITs. The company's portfolio includes an interest in 482 properties, which includes over 57 million square feet of retail space following the completion of the Urstadt Biddle acquisition in August 2023. The portfolio is geographically diversified with 22 regional offices and no single market representing more than 12% of total company net operating income. Regency's retail portfolio is primarily composed of grocery-anchored centers, with 80% of properties featuring a grocery anchor and grocery stores representing 20% of annual base rent.

Regency Centers: Financial Performance Dissected

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Regency Centers's revenue growth over a period of 3M has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 4.69%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Real Estate sector.

Net Margin: Regency Centers's net margin is impressive, surpassing industry averages. With a net margin of 27.87%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Regency Centers's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 1.64%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.85%, the company showcases effective utilization of assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.81.

Understanding the Relevance of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for REG

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Feb 2022 | Compass Point | Maintains | Neutral | |

| Jan 2022 | Deutsche Bank | Upgrades | Hold | Buy |

Posted-In: BZI-AARAnalyst Ratings