What Analysts Are Saying About Qualcomm Stock

In the preceding three months, 6 analysts have released ratings for Qualcomm (NASDAQ:QCOM), presenting a wide array of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 2 | 2 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

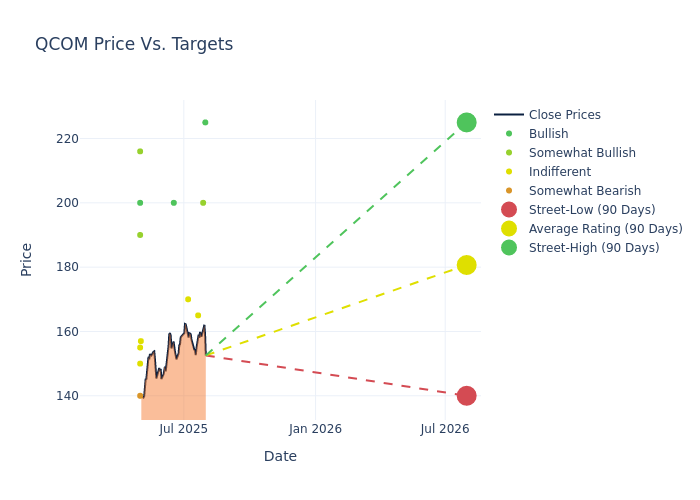

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $191.67, a high estimate of $225.00, and a low estimate of $165.00. This upward trend is evident, with the current average reflecting a 1.32% increase from the previous average price target of $189.17.

Decoding Analyst Ratings: A Detailed Look

The standing of Qualcomm among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Kevin Cassidy | Rosenblatt | Maintains | Buy | $225.00 | $225.00 |

| Samik Chatterjee | JP Morgan | Raises | Overweight | $200.00 | $190.00 |

| Timothy Arcuri | UBS | Raises | Neutral | $165.00 | $145.00 |

| Samik Chatterjee | JP Morgan | Raises | Overweight | $190.00 | $185.00 |

| Christopher Danely | Citigroup | Raises | Neutral | $170.00 | $145.00 |

| Tal Liani | B of A Securities | Lowers | Buy | $200.00 | $245.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Qualcomm. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Qualcomm compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Qualcomm's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of Qualcomm's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Qualcomm analyst ratings.

About Qualcomm

Qualcomm develops and licenses wireless technology and designs chips for smartphones. The company's key patents revolve around CDMA and OFDMA technologies, which are standards in wireless communications that are the backbone of all 3G, 4G, and 5G networks. Qualcomm's IP is licensed by virtually all wireless device makers. The firm is also the world's largest wireless chip vendor, supplying nearly every premier handset maker with leading-edge processors. Qualcomm also sells RF-front end modules into smartphones, as well as chips into automotive and Internet of Things markets.

Breaking Down Qualcomm's Financial Performance

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Qualcomm's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 16.93%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Net Margin: Qualcomm's net margin excels beyond industry benchmarks, reaching 25.61%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Qualcomm's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 10.3% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Qualcomm's ROA stands out, surpassing industry averages. With an impressive ROA of 5.07%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Qualcomm's debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.53, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

The Significance of Analyst Ratings Explained

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for QCOM

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Mizuho | Maintains | Buy | |

| Feb 2022 | Morgan Stanley | Maintains | Overweight | |

| Feb 2022 | JP Morgan | Maintains | Overweight |

Posted-In: BZI-AARAnalyst Ratings