What 6 Analyst Ratings Have To Say About Element Solutions

Ratings for Element Solutions (NYSE:ESI) were provided by 6 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 2 | 1 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

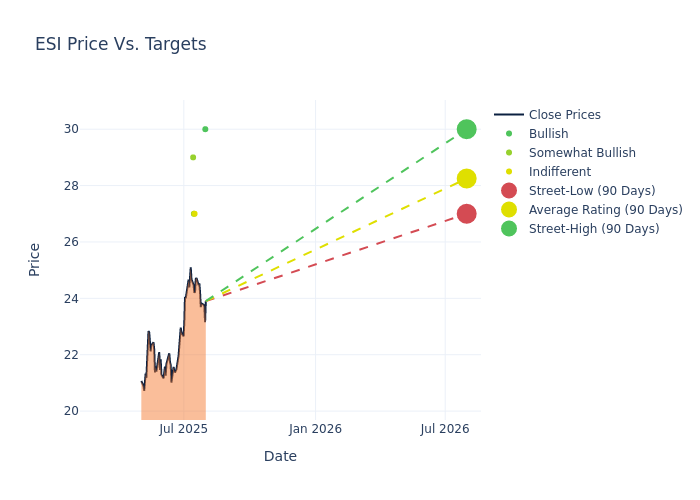

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $27.67, along with a high estimate of $30.00 and a low estimate of $24.00. This upward trend is apparent, with the current average reflecting a 8.51% increase from the previous average price target of $25.50.

Deciphering Analyst Ratings: An In-Depth Analysis

The standing of Element Solutions among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Joshua Spector | UBS | Raises | Buy | $30.00 | $29.00 |

| Duffy Fischer | Goldman Sachs | Raises | Neutral | $27.00 | $24.00 |

| John Roberts | Mizuho | Raises | Outperform | $27.00 | $24.00 |

| Aleksey Yefremov | Keybanc | Raises | Overweight | $29.00 | $28.00 |

| Joshua Spector | UBS | Raises | Buy | $29.00 | $25.00 |

| John Roberts | Mizuho | Raises | Outperform | $24.00 | $23.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Element Solutions. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Element Solutions compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Element Solutions's stock. This examination reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Element Solutions's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Element Solutions analyst ratings.

About Element Solutions

Element Solutions Inc is a specialty chemicals company whose businesses supply a broad range of solutions that enhance the performance of products people use every day. The company's reportable segments are Electronics and Industrial & Specialty. The Electronics segment, which generates maximum revenue, researches, formulates, and sells specialty chemicals and process technologies for all types of electronics hardware, from complex printed circuit board designs to semiconductor packaging. This segment's wet chemicals for metallization, surface treatments, and solderable finishes form the physical circuitry pathways, and its assembly materials, such as solder, pastes, fluxes, and adhesives, join those pathways together.

Element Solutions's Financial Performance

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Element Solutions's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 3.25%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Materials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 16.51%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Element Solutions's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 4.0%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Element Solutions's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.03% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Element Solutions's debt-to-equity ratio is below the industry average. With a ratio of 0.64, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Significance of Analyst Ratings Explained

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for ESI

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | CL King | Initiates Coverage On | Buy | |

| Jan 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Oct 2021 | Mizuho | Initiates Coverage On | Buy |

Posted-In: BZI-AARAnalyst Ratings