Where WESCO Intl Stands With Analysts

Providing a diverse range of perspectives from bullish to bearish, 7 analysts have published ratings on WESCO Intl (NYSE:WCC) in the last three months.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 4 | 1 | 0 | 0 |

| Last 30D | 1 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 1 | 2 | 0 | 0 | 0 |

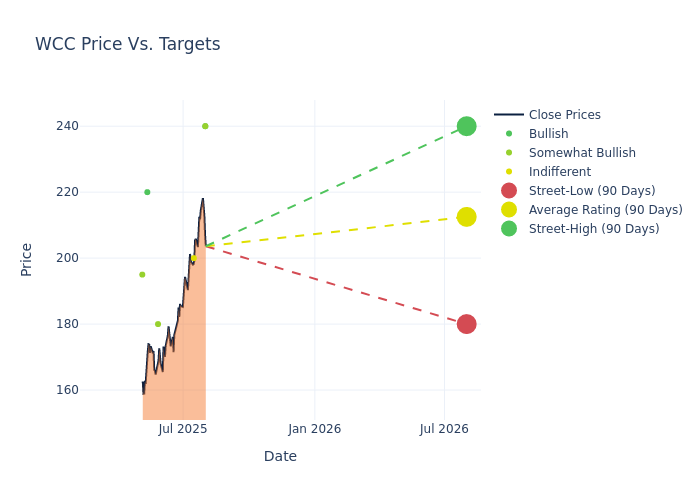

Insights from analysts' 12-month price targets are revealed, presenting an average target of $212.14, a high estimate of $240.00, and a low estimate of $180.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 0.67%.

Interpreting Analyst Ratings: A Closer Look

The perception of WESCO Intl by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Sam Darkatsh | Raymond James | Raises | Strong Buy | $240.00 | $230.00 |

| Ken Newman | Keybanc | Raises | Overweight | $240.00 | $210.00 |

| Tommy Moll | Stephens & Co. | Raises | Equal-Weight | $200.00 | $190.00 |

| Ken Newman | Keybanc | Raises | Overweight | $210.00 | $180.00 |

| Stephen Tusa | JP Morgan | Lowers | Overweight | $180.00 | $210.00 |

| Chris Dankert | Loop Capital | Lowers | Buy | $220.00 | $250.00 |

| Christopher Glynn | Oppenheimer | Lowers | Outperform | $195.00 | $225.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to WESCO Intl. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of WESCO Intl compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of WESCO Intl's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of WESCO Intl's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on WESCO Intl analyst ratings.

About WESCO Intl

Wesco can be traced back to the late 1800s but was officially founded in 1922, acting as the distribution arm of Westinghouse Electric. Throughout the 1900s, Wesco entered and subsequently exited the consumer electronics, transit, bottling, and nuclear plant distribution markets. It was sold to a private equity firm in 1994 and then went public in 1999, and numerous acquisitions have since been made to fill the gaps in Wesco's geographical and product coverage. Today, the firm primarily distributes electrical, networking, security, and utility equipment used in the construction and repair of structures such as offices, data centers, power transmission lines, and manufacturing plants. Wesco has operations around the globe but generates the majority of its revenue in the United States.

WESCO Intl's Economic Impact: An Analysis

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3M period, WESCO Intl faced challenges, resulting in a decline of approximately -0.12% in revenue growth as of 31 March, 2025. This signifies a reduction in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: WESCO Intl's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 1.95%, the company may face hurdles in effective cost management.

Return on Equity (ROE): WESCO Intl's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 2.08%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): WESCO Intl's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.68%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 1.15, WESCO Intl adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Core of Analyst Ratings: What Every Investor Should Know

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for WCC

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Loop Capital | Maintains | Buy | |

| Nov 2021 | Raymond James | Maintains | Strong Buy | |

| Nov 2021 | Stephens & Co. | Maintains | Overweight |

Posted-In: BZI-AARAnalyst Ratings