5 Analysts Have This To Say About IDEXX Laboratories

Across the recent three months, 5 analysts have shared their insights on IDEXX Laboratories (NASDAQ:IDXX), expressing a variety of opinions spanning from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 3 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

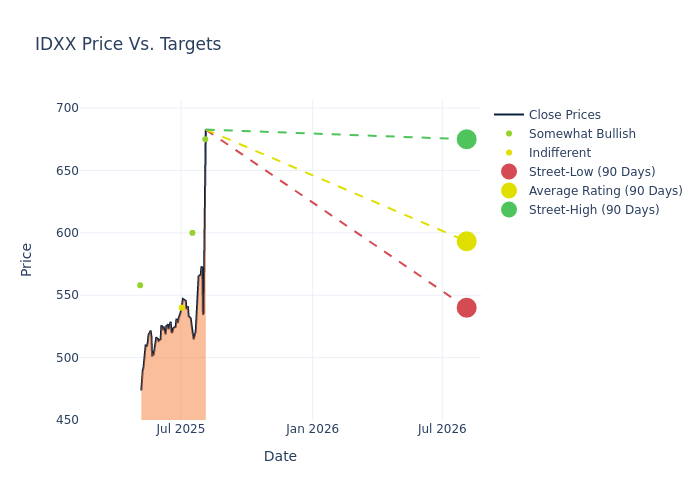

Analysts have recently evaluated IDEXX Laboratories and provided 12-month price targets. The average target is $581.0, accompanied by a high estimate of $675.00 and a low estimate of $510.00. Witnessing a positive shift, the current average has risen by 11.09% from the previous average price target of $523.00.

Investigating Analyst Ratings: An Elaborate Study

The perception of IDEXX Laboratories by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Chris Schott | JP Morgan | Raises | Overweight | $675.00 | $550.00 |

| Daniel Clark | Leerink Partners | Raises | Outperform | $600.00 | $580.00 |

| Jonathan Block | Stifel | Raises | Hold | $540.00 | $510.00 |

| Daniel Clark | Leerink Partners | Raises | Outperform | $580.00 | $515.00 |

| Jonathan Block | Stifel | Raises | Hold | $510.00 | $460.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to IDEXX Laboratories. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of IDEXX Laboratories compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of IDEXX Laboratories's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into IDEXX Laboratories's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on IDEXX Laboratories analyst ratings.

All You Need to Know About IDEXX Laboratories

Idexx Laboratories primarily develops, manufactures, and distributes diagnostic products, equipment, and services for pets and livestock. Its key product lines include single-use canine and feline test kits that veterinarians can employ in the office, benchtop chemistry and hematology analyzers for test-panel analysis on-site, reference lab services, and tests to detect and manage disease in livestock. The firm also offers vet practice management software and consulting services to animal hospitals. Idexx gets close to 35% of its revenue from outside the United States.

Key Indicators: IDEXX Laboratories's Financial Health

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: IDEXX Laboratories's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 3.56%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: IDEXX Laboratories's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 24.31% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): IDEXX Laboratories's ROE excels beyond industry benchmarks, reaching 15.95%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): IDEXX Laboratories's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 7.46% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 0.73, IDEXX Laboratories adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Significance of Analyst Ratings Explained

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for IDXX

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Atlantic Equities | Initiates Coverage On | Overweight | |

| Nov 2021 | Morgan Stanley | Initiates Coverage On | Overweight | |

| Aug 2021 | Credit Suisse | Maintains | Outperform |

Posted-In: BZI-AARAnalyst Ratings