A Glimpse Into The Expert Outlook On Selective Insurance Gr Through 6 Analysts

In the latest quarter, 6 analysts provided ratings for Selective Insurance Gr (NASDAQ:SIGI), showcasing a mix of bullish and bearish perspectives.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 4 | 1 | 0 |

| Last 30D | 0 | 1 | 0 | 1 | 0 |

| 1M Ago | 0 | 0 | 3 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

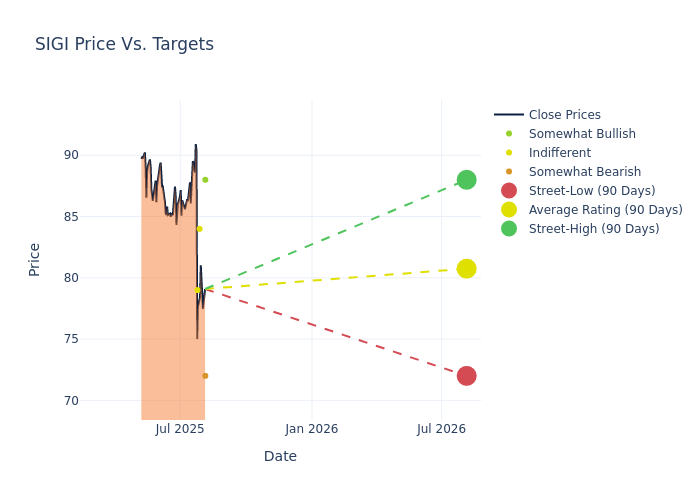

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $83.17, a high estimate of $90.00, and a low estimate of $72.00. Observing a downward trend, the current average is 7.07% lower than the prior average price target of $89.50.

Decoding Analyst Ratings: A Detailed Look

In examining recent analyst actions, we gain insights into how financial experts perceive Selective Insurance Gr. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Zaremski | BMO Capital | Lowers | Outperform | $88.00 | $96.00 |

| Bob Huang | Morgan Stanley | Lowers | Underweight | $72.00 | $86.00 |

| Meyer Shields | Keefe, Bruyette & Woods | Lowers | Market Perform | $84.00 | $92.00 |

| Paul Newsome | Piper Sandler | Lowers | Neutral | $79.00 | $88.00 |

| Bob Huang | Morgan Stanley | Lowers | Equal-Weight | $86.00 | $90.00 |

| Bob Huang | Morgan Stanley | Raises | Equal-Weight | $90.00 | $85.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Selective Insurance Gr. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Selective Insurance Gr compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Selective Insurance Gr's stock. This analysis reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Selective Insurance Gr's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Selective Insurance Gr analyst ratings.

Discovering Selective Insurance Gr: A Closer Look

Selective Insurance Group Inc is a regional property-casualty insurer based in New Jersey, with its operations focused in the New York metropolitan area. The Company has four operating segments: Standard Commercial Lines, Standard Personal Lines, E&S Lines, Investments. Majority of revenue is gained from Standard Personal Lines. Currently company has it's revenues from States of USA and Columbia.

Selective Insurance Gr's Financial Performance

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Selective Insurance Gr's remarkable performance in 3M is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 10.94%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Financials sector.

Net Margin: Selective Insurance Gr's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 6.3%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 2.69%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Selective Insurance Gr's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.58%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Selective Insurance Gr's debt-to-equity ratio surpasses industry norms, standing at 0.28. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Understanding the Relevance of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for SIGI

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Aug 2021 | Wolfe Research | Initiates Coverage On | Outperform | |

| Jul 2021 | RBC Capital | Maintains | Sector Perform | |

| Jul 2021 | JMP Securities | Downgrades | Outperform | Market Perform |

Posted-In: BZI-AARAnalyst Ratings