A Glimpse Into The Expert Outlook On Alpha Metallurgical Through 4 Analysts

Analysts' ratings for Alpha Metallurgical (NYSE:AMR) over the last quarter vary from bullish to bearish, as provided by 4 analysts.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 0 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

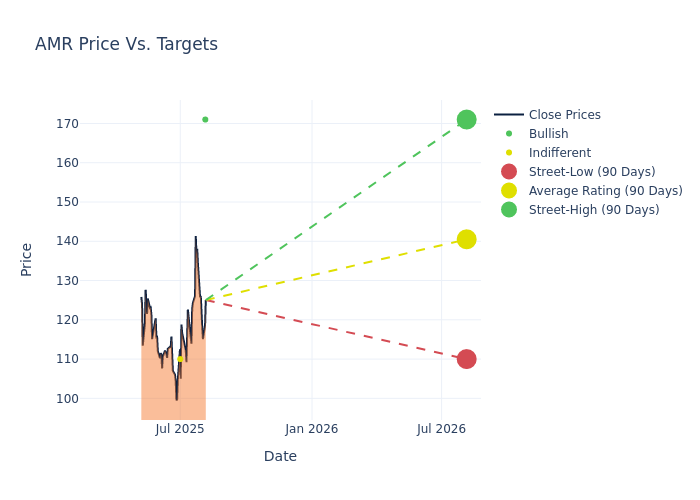

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $158.75, with a high estimate of $181.00 and a low estimate of $110.00. Observing a downward trend, the current average is 11.31% lower than the prior average price target of $179.00.

Analyzing Analyst Ratings: A Detailed Breakdown

A clear picture of Alpha Metallurgical's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Lucas Pipes | B. Riley Securities | Lowers | Buy | $171.00 | $173.00 |

| Lucas Pipes | B. Riley Securities | Lowers | Buy | $173.00 | $181.00 |

| Christopher LeFemina | Jefferies | Announces | Hold | $110.00 | - |

| Lucas Pipes | B. Riley Securities | Lowers | Buy | $181.00 | $183.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Alpha Metallurgical. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Alpha Metallurgical compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Alpha Metallurgical's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Alpha Metallurgical's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Alpha Metallurgical analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

About Alpha Metallurgical

Alpha Metallurgical Resources Inc is a Tennessee-based coal mining company with operations across Virginia and West Virginia. The company's portfolio of mining operations consists of underground mines, surface mines, and coal preparation plants. It produces low-ash metallurgical coal, including High-Vol. A, Mid-Vol., High-Vol. B, and Low-Vol. coal, which is shipped to domestic and international coke and steel producers. The reportable segment of the company is Met. It extracts, processes and markets met and thermal coal from deep and surface mines for sale to steel and coke producers, industrial customers, and electric utilities.

Alpha Metallurgical's Economic Impact: An Analysis

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Decline in Revenue: Over the 3M period, Alpha Metallurgical faced challenges, resulting in a decline of approximately -38.44% in revenue growth as of 31 March, 2025. This signifies a reduction in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Materials sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of -6.38%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Alpha Metallurgical's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -2.08%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Alpha Metallurgical's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -1.4%, the company may face hurdles in achieving optimal financial performance.

Debt Management: With a below-average debt-to-equity ratio of 0.0, Alpha Metallurgical adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: What Are They?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for AMR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | B. Riley Securities | Upgrades | Neutral | Buy |

| Feb 2019 | Guggenheim | Downgrades | Buy | Sell |

| Nov 2018 | Goldman Sachs | Downgrades | Buy | Neutral |

Posted-In: BZI-AARAnalyst Ratings