Breaking Down Block: 18 Analysts Share Their Views

Across the recent three months, 18 analysts have shared their insights on Block (NYSE:XYZ), expressing a variety of opinions spanning from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 10 | 1 | 1 | 3 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 6 | 0 | 0 | 1 |

| 2M Ago | 1 | 2 | 0 | 1 | 0 |

| 3M Ago | 1 | 2 | 0 | 0 | 2 |

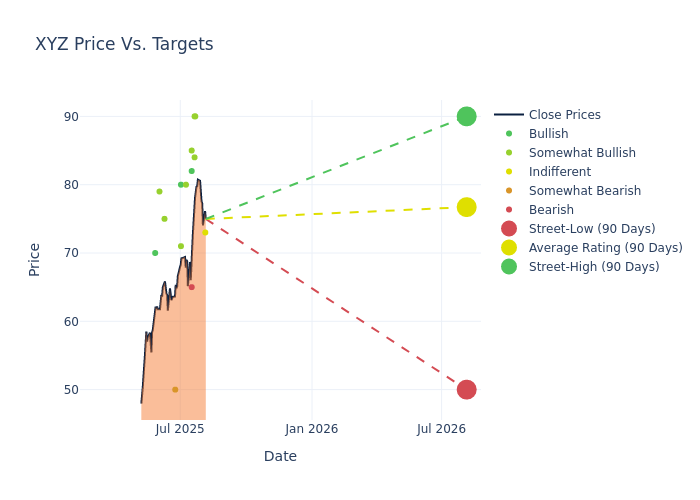

The 12-month price targets, analyzed by analysts, offer insights with an average target of $74.61, a high estimate of $90.00, and a low estimate of $50.00. Marking an increase of 11.84%, the current average surpasses the previous average price target of $66.71.

Interpreting Analyst Ratings: A Closer Look

The perception of Block by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| James Faucette | Morgan Stanley | Maintains | Equal-Weight | $73.00 | $73.00 |

| Harshita Rawat | Bernstein | Raises | Outperform | $90.00 | $75.00 |

| Tien-Tsin Huang | JP Morgan | Raises | Overweight | $90.00 | $60.00 |

| David Koning | Baird | Raises | Outperform | $84.00 | $76.00 |

| Bryan Keane | Deutsche Bank | Announces | Buy | $82.00 | - |

| Matthew Coad | Truist Securities | Raises | Sell | $65.00 | $61.00 |

| Adam Frisch | Evercore ISI Group | Raises | Outperform | $85.00 | $75.00 |

| Vasundhara Govil | Keefe, Bruyette & Woods | Raises | Outperform | $80.00 | $70.00 |

| James Faucette | Morgan Stanley | Raises | Overweight | $73.00 | $65.00 |

| Rayna Kumar | Oppenheimer | Raises | Outperform | $71.00 | $70.00 |

| Dominick Gabriele | Compass Point | Announces | Buy | $80.00 | - |

| Patrick Moley | Piper Sandler | Announces | Underweight | $50.00 | - |

| Ramsey El-Assal | Barclays | Raises | Overweight | $75.00 | $57.00 |

| Matthew Coad | Truist Securities | Raises | Sell | $61.00 | $60.00 |

| Adam Frisch | Evercore ISI Group | Raises | Outperform | $75.00 | $58.00 |

| John Davis | Raymond James | Raises | Outperform | $79.00 | $74.00 |

| Matthew Coad | Truist Securities | Announces | Sell | $60.00 | - |

| Trevor Williams | Jefferies | Raises | Buy | $70.00 | $60.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Block. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Block compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Block's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Block's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Block analyst ratings.

About Block

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2024, Square's payment volume was almost USD 250 million.

Financial Milestones: Block's Journey

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining Block's financials over 3M reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -3.11% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Financials sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 3.29%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Block's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 0.89%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.52%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.28, Block adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted-In: BZI-AARAnalyst Ratings