Where Trimble Stands With Analysts

5 analysts have shared their evaluations of Trimble (NASDAQ:TRMB) during the recent three months, expressing a mix of bullish and bearish perspectives.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 5 | 0 | 0 | 0 |

| Last 30D | 0 | 2 | 0 | 0 | 0 |

| 1M Ago | 0 | 2 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

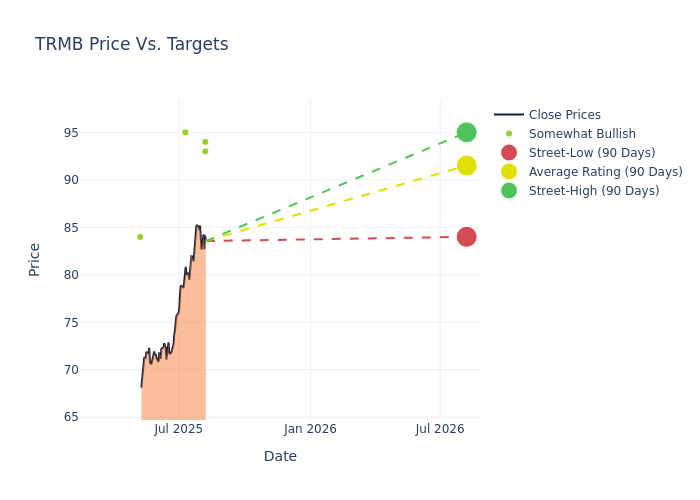

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $91.6, a high estimate of $95.00, and a low estimate of $88.00. Marking an increase of 7.51%, the current average surpasses the previous average price target of $85.20.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Trimble among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Kristen Owen | Oppenheimer | Raises | Outperform | $94.00 | $88.00 |

| Brian Gesuale | Raymond James | Raises | Outperform | $93.00 | $85.00 |

| Kristen Owen | Oppenheimer | Raises | Outperform | $88.00 | $81.00 |

| Tami Zakaria | JP Morgan | Raises | Overweight | $95.00 | $88.00 |

| Tami Zakaria | JP Morgan | Raises | Overweight | $88.00 | $84.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Trimble. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Trimble compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Trimble's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

To gain a panoramic view of Trimble's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Trimble analyst ratings.

All You Need to Know About Trimble

Trimble Inc is a technology solutions provider that enables office and mobile professionals to connect their workflows and asset lifecycles to drive a more productive, sustainable future. The company has three reportable segments: Architects, Engineers, Construction, and Owners (AECO). This segment provides software solutions that sell through a direct channel to customers in the construction industry. Field Systems. This segment provides hardware and associated software solutions that sell through dealer partner channels. Transportation and Logistics (T&L). This segment provides solutions for customers working in long-haul trucking and freight shipping markets.

Breaking Down Trimble's Financial Performance

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Decline in Revenue: Over the 3M period, Trimble faced challenges, resulting in a decline of approximately -11.82% in revenue growth as of 31 March, 2025. This signifies a reduction in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Trimble's net margin is impressive, surpassing industry averages. With a net margin of 7.93%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 1.19%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Trimble's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.73%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.26.

The Basics of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for TRMB

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Raymond James | Maintains | Outperform | |

| Feb 2022 | Piper Sandler | Maintains | Overweight | |

| Jan 2022 | Morgan Stanley | Maintains | Underweight |

Posted-In: BZI-AARAnalyst Ratings