Assessing Parsons: Insights From 9 Financial Analysts

Ratings for Parsons (NYSE:PSN) were provided by 9 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 3 | 1 | 0 | 0 |

| Last 30D | 0 | 2 | 0 | 0 | 0 |

| 1M Ago | 2 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 1 | 0 | 0 |

| 3M Ago | 2 | 0 | 0 | 0 | 0 |

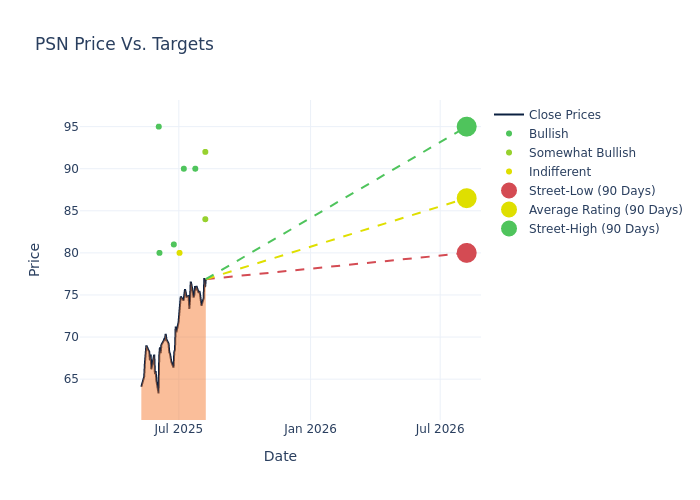

The 12-month price targets, analyzed by analysts, offer insights with an average target of $86.0, a high estimate of $95.00, and a low estimate of $80.00. This upward trend is evident, with the current average reflecting a 5.06% increase from the previous average price target of $81.86.

Breaking Down Analyst Ratings: A Detailed Examination

The analysis of recent analyst actions sheds light on the perception of Parsons by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Sangita Jain | Keybanc | Raises | Overweight | $84.00 | $82.00 |

| Andrew Wittmann | Baird | Raises | Outperform | $92.00 | $78.00 |

| Tobey Sommer | Truist Securities | Raises | Buy | $90.00 | $80.00 |

| Eric Heath | Keybanc | Raises | Overweight | $82.00 | $73.00 |

| Brian Gesuale | Raymond James | Announces | Strong Buy | $90.00 | - |

| Sheila Kahyaoglu | Jefferies | Raises | Hold | $80.00 | $70.00 |

| Jonathan Siegmann | Stifel | Announces | Buy | $81.00 | - |

| Noah Poponak | Goldman Sachs | Lowers | Buy | $80.00 | $90.00 |

| Ronald Epstein | B of A Securities | Lowers | Buy | $95.00 | $100.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Parsons. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Parsons compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Parsons's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Parsons's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Parsons analyst ratings.

Delving into Parsons's Background

Parsons Corp is a provider of technology-driven solutions in the defense, intelligence, and critical infrastructure markets. The business activities of the group are carried out through Federal Solutions and Critical Infrastructure segments. The Federal Solutions segment is a high-end service and technology provider to the U.S. government, delivering timely, cost-effective solutions for mission-critical projects, whereas the Critical Infrastructure segment provides integrated design and engineering services for complex physical and digital infrastructure around the globe.

Parsons's Financial Performance

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Parsons displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 1.22%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 4.26%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Parsons's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 2.72%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Parsons's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 1.21%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Parsons's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.56.

The Significance of Analyst Ratings Explained

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for PSN

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | B of A Securities | Upgrades | Underperform | Neutral |

| Mar 2022 | Raymond James | Initiates Coverage On | Outperform | |

| Dec 2021 | William Blair | Downgrades | Outperform | Market Perform |

Posted-In: BZI-AARAnalyst Ratings