Maplebear Stock: A Deep Dive Into Analyst Perspectives (11 Ratings)

11 analysts have expressed a variety of opinions on Maplebear (NASDAQ:CART) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 4 | 2 | 0 | 0 |

| Last 30D | 2 | 1 | 1 | 0 | 0 |

| 1M Ago | 1 | 2 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 1 | 0 | 0 |

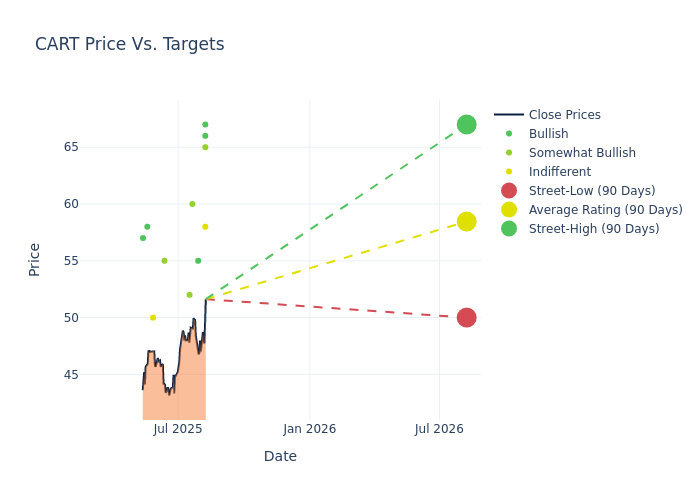

Analysts have recently evaluated Maplebear and provided 12-month price targets. The average target is $58.45, accompanied by a high estimate of $67.00 and a low estimate of $50.00. Observing a 9.05% increase, the current average has risen from the previous average price target of $53.60.

Deciphering Analyst Ratings: An In-Depth Analysis

The perception of Maplebear by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Mark Zgutowicz | Benchmark | Announces | Buy | $67.00 | - |

| Ross Sandler | Barclays | Raises | Overweight | $65.00 | $61.00 |

| Justin Post | B of A Securities | Raises | Neutral | $58.00 | $53.00 |

| Bernie McTernan | Needham | Raises | Buy | $66.00 | $56.00 |

| Mark Kelley | Stifel | Raises | Buy | $55.00 | $54.00 |

| Nikhil Devnani | Bernstein | Raises | Outperform | $60.00 | $55.00 |

| Colin Sebastian | Baird | Raises | Outperform | $52.00 | $47.00 |

| Andrew Boone | JMP Securities | Maintains | Market Outperform | $55.00 | $55.00 |

| John Colantuoni | Jefferies | Raises | Hold | $50.00 | $48.00 |

| Rob Sanderson | Loop Capital | Raises | Buy | $58.00 | $52.00 |

| Ronald Josey | Citigroup | Raises | Buy | $57.00 | $55.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Maplebear. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Maplebear compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Maplebear's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Maplebear's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Maplebear analyst ratings.

About Maplebear

Maplebear (Instacart) operates a leading grocery delivery platform in the United States and Canada. The company partners with various regional and national grocers, which offer their selection of food and other goods to customers through Instacart's ubiquitous platform. Once an item is ordered through Instacart's site, the item is picked and delivered to the customer's home by one of the platform's 600,000 shoppers, who are classified as independent contractors. Instacart earns fees based on average order value and leverages its platform's high usage to sell advertising, mainly to consumer-packaged goods companies. Instacart currently has about 8 million monthly active users (or orderers) on its platform.

Maplebear: A Financial Overview

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Over the 3M period, Maplebear showcased positive performance, achieving a revenue growth rate of 9.39% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Staples sector.

Net Margin: Maplebear's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 11.59%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Maplebear's ROE excels beyond industry benchmarks, reaching 3.32%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Maplebear's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.47% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Maplebear's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.01.

How Are Analyst Ratings Determined?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted-In: BZI-AARAnalyst Ratings