What 7 Analyst Ratings Have To Say About Iovance Biotherapeutics

Iovance Biotherapeutics (NASDAQ:IOVA) underwent analysis by 7 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 3 | 1 | 0 | 0 |

| Last 30D | 1 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 2 | 1 | 0 | 0 |

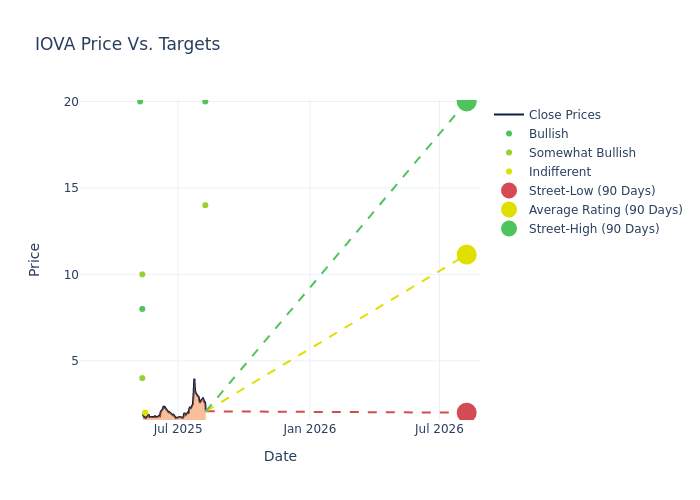

Insights from analysts' 12-month price targets are revealed, presenting an average target of $11.86, a high estimate of $25.00, and a low estimate of $2.00. A 38.96% drop is evident in the current average compared to the previous average price target of $19.43.

Understanding Analyst Ratings: A Comprehensive Breakdown

The perception of Iovance Biotherapeutics by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Yanan Zhu | Wells Fargo | Lowers | Overweight | $14.00 | $18.00 |

| Geulah Livshits | Chardan Capital | Lowers | Buy | $20.00 | $25.00 |

| Geulah Livshits | Chardan Capital | Maintains | Buy | $25.00 | $25.00 |

| David Dai | UBS | Lowers | Neutral | $2.00 | $17.00 |

| Andrea Tan | Goldman Sachs | Lowers | Buy | $8.00 | $16.00 |

| Mara Goldstein | Mizuho | Lowers | Outperform | $10.00 | $30.00 |

| Peter Lawson | Barclays | Lowers | Overweight | $4.00 | $5.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Iovance Biotherapeutics. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Iovance Biotherapeutics compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Iovance Biotherapeutics's stock. This analysis reveals shifts in analysts' expectations over time.

To gain a panoramic view of Iovance Biotherapeutics's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Iovance Biotherapeutics analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Get to Know Iovance Biotherapeutics Better

Iovance Biotherapeutics Inc is a clinical-stage biopharmaceutical company, pioneering a transformational approach to treating cancer by harnessing the human immune system's ability to recognize and destroy diverse cancer cells using therapies personalized for each patient. The company is preparing for potential U.S. regulatory approvals and commercialization of the first autologous T-cell therapy to address a solid tumor cancer. its objective is to be the leader in innovating, developing, and delivering tumor-infiltrating lymphocyte, or TIL, therapies for patients with solid tumor cancers.

Understanding the Numbers: Iovance Biotherapeutics's Finances

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Iovance Biotherapeutics's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 6798.46%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: Iovance Biotherapeutics's net margin excels beyond industry benchmarks, reaching -235.51%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -15.72%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Iovance Biotherapeutics's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -12.38%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Iovance Biotherapeutics's debt-to-equity ratio is below the industry average. With a ratio of 0.07, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Core of Analyst Ratings: What Every Investor Should Know

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for IOVA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Baird | Maintains | Outperform | |

| Feb 2022 | Chardan Capital | Maintains | Buy | |

| Jan 2022 | Stifel | Upgrades | Hold | Buy |

Posted-In: BZI-AARAnalyst Ratings