9 Analysts Assess Advanced Drainage Systems: What You Need To Know

Providing a diverse range of perspectives from bullish to bearish, 9 analysts have published ratings on Advanced Drainage Systems (NYSE:WMS) in the last three months.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 6 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 2 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 3 | 0 | 0 | 0 |

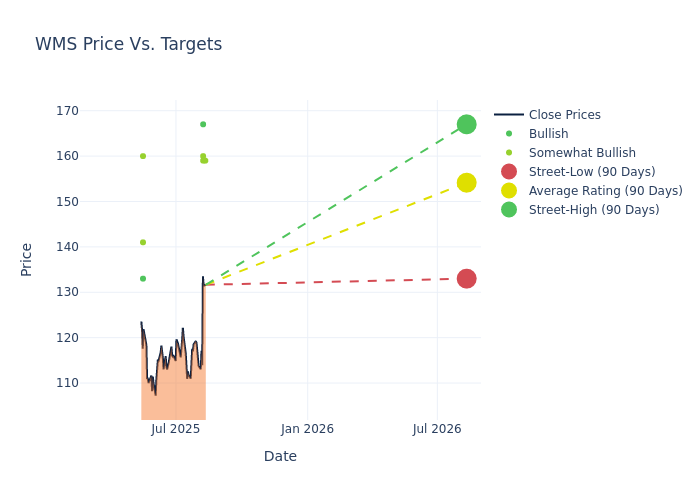

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $151.11, along with a high estimate of $167.00 and a low estimate of $133.00. Marking an increase of 4.21%, the current average surpasses the previous average price target of $145.00.

Exploring Analyst Ratings: An In-Depth Overview

An in-depth analysis of recent analyst actions unveils how financial experts perceive Advanced Drainage Systems. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jeffrey Reive | RBC Capital | Announces | Outperform | $159.00 | - |

| John Lovallo | UBS | Raises | Buy | $167.00 | $146.00 |

| Jeffrey Hammond | Keybanc | Raises | Overweight | $159.00 | $140.00 |

| Matthew Bouley | Barclays | Raises | Overweight | $160.00 | $135.00 |

| John Lovallo | UBS | Lowers | Buy | $146.00 | $155.00 |

| Bryan Blair | Oppenheimer | Lowers | Outperform | $160.00 | $165.00 |

| Michael Halloran | Baird | Lowers | Outperform | $141.00 | $146.00 |

| Garik Shmois | Loop Capital | Lowers | Buy | $133.00 | $143.00 |

| Matthew Bouley | Barclays | Raises | Overweight | $135.00 | $130.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Advanced Drainage Systems. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Advanced Drainage Systems compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Advanced Drainage Systems's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Advanced Drainage Systems analyst ratings.

Delving into Advanced Drainage Systems's Background

Advanced Drainage Systems Inc is the manufacturer of water management solutions in the stormwater and onsite septic wastewater industries, providing superior drainage solutions for use in the construction and agriculture marketplaces. Its products are used across a broad range of end markets and applications, including residential, non-residential, infrastructure and agriculture applications. It operates business in three distinct reportable segments: Pipe; International, and Infiltrator. It generates a greater proportion of revenue from its Pipe segment, which consists of Pipe product sales in the United States. The Infiltrator is a provider of plastic leachfield chambers and systems, septic tanks and accessories, for use in residential applications.

Advanced Drainage Systems: Financial Performance Dissected

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Advanced Drainage Systems's revenue growth over a period of 3M has been noteworthy. As of 30 June, 2025, the company achieved a revenue growth rate of approximately 1.78%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 17.34%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 8.52%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Advanced Drainage Systems's ROA excels beyond industry benchmarks, reaching 3.79%. This signifies efficient management of assets and strong financial health.

Debt Management: Advanced Drainage Systems's debt-to-equity ratio is below the industry average at 0.81, reflecting a lower dependency on debt financing and a more conservative financial approach.

How Are Analyst Ratings Determined?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for WMS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Morgan Stanley | Upgrades | Equal-Weight | Overweight |

| Dec 2021 | Barclays | Maintains | Overweight | |

| Nov 2021 | Barclays | Maintains | Overweight |

Posted-In: BZI-AARAnalyst Ratings