Earnings Preview For Elevance Health

Elevance Health (NYSE:ELV) is preparing to release its quarterly earnings on Thursday, 2025-07-17. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Elevance Health to report an earnings per share (EPS) of $9.19.

Elevance Health bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

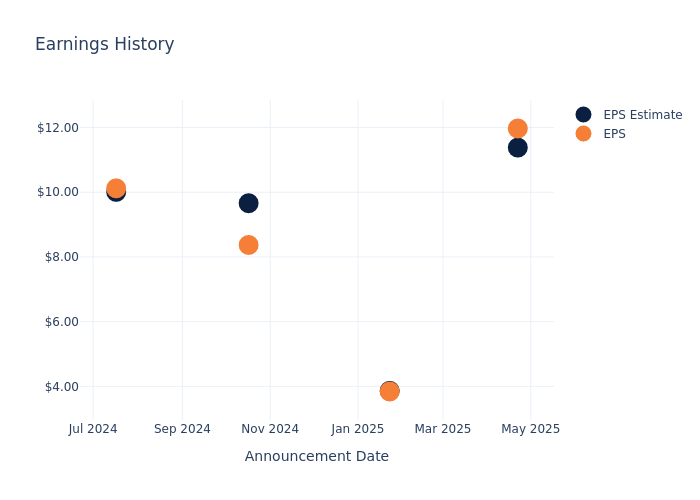

Earnings Track Record

During the last quarter, the company reported an EPS beat by $0.59, leading to a 2.64% increase in the share price on the subsequent day.

Here's a look at Elevance Health's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 11.38 | 3.86 | 9.66 | 10.01 |

| EPS Actual | 11.97 | 3.84 | 8.37 | 10.12 |

| Price Change % | 3.0% | -0.0% | -3.0% | -3.0% |

Market Performance of Elevance Health's Stock

Shares of Elevance Health were trading at $336.21 as of July 15. Over the last 52-week period, shares are down 32.65%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Analyst Observations about Elevance Health

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Elevance Health.

Analysts have provided Elevance Health with 11 ratings, resulting in a consensus rating of Outperform. The average one-year price target stands at $476.73, suggesting a potential 41.8% upside.

Comparing Ratings with Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Molina Healthcare, HealthEquity and Alignment Healthcare, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Molina Healthcare, with an average 1-year price target of $347.71, suggesting a potential 3.42% upside.

- Analysts currently favor an Outperform trajectory for HealthEquity, with an average 1-year price target of $116.88, suggesting a potential 65.24% downside.

- Analysts currently favor an Neutral trajectory for Alignment Healthcare, with an average 1-year price target of $17.0, suggesting a potential 94.94% downside.

Key Findings: Peer Analysis Summary

The peer analysis summary presents essential metrics for Molina Healthcare, HealthEquity and Alignment Healthcare, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Centene | Neutral | 15.38% | $5.20B | 4.83% |

| Molina Healthcare | Neutral | 12.24% | $1.28B | 6.77% |

| HealthEquity | Outperform | 15.04% | $224.31M | 2.54% |

| Alignment Healthcare | Neutral | 47.46% | $106.03M | -8.76% |

Key Takeaway:

Elevance Health ranks in the middle for revenue growth among its peers. It is at the bottom for gross profit and return on equity.

All You Need to Know About Elevance Health

Elevance Health remains one of the leading health insurers in the US, providing medical benefits to 46 million medical members as of December 2024. The company offers employer, individual, and government-sponsored coverage plans. Elevance differs from its peers in its unique position as the largest single provider of Blue Cross Blue Shield branded coverage, operating as the licensee for the Blue Cross Blue Shield Association in 14 states. Through acquisitions, such as the Amerigroup deal in 2012 and MMM in 2021, Elevance's reach expands beyond those states through government-sponsored programs, such as Medicaid and Medicare Advantage plans, too. It is also an emerging player in pharmacy benefit management and other healthcare services.

Elevance Health: Delving into Financials

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Elevance Health's revenue growth over a period of 3 months has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 14.83%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Elevance Health's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 4.46%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Elevance Health's ROE excels beyond industry benchmarks, reaching 5.21%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Elevance Health's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.85% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.71.

To track all earnings releases for Elevance Health visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.